Hi:

I am 16 and would like to get a motorcycle. I don’t know how much will insurance cost me, and it’s impossible to find this information over the Internet (too many factors).

I found out that even if I get a scooter/moped (maximum 50cc), it still counts as a “bike” in terms of the insurance.

So, can you please try and find some information on this?

Thank you!

Dear ——-!

Table of Contents

How Much Is Motorcycle Insurance For A 16 Year Old

The price of motorcycle insurance varies greatly depending upon the type of bike and the rider’s age, sex, and record. You may want to check with your auto insurer or agent at work before taking out a separate policy.

If you’re under 25, many insurers simply refuse coverage if you mention you own a motorcycle. That’s because motorcycles are dangerous, requiring riders to be mature enough to cope with risks that passengers in cars never face.

Even if you’re over that age but under 25, your insurer may charge you more than for an auto policy. Experienced riders who do most of their biking on weekends and commuter roads will pay the least; those doing all-out road riding (where bikes go 140 mph or faster) or taking part in competitive events will pay the most. The best way to find out how much insurance will cost is to ask for quotes from several insurers.

The following table contains average rates according to age and location throughout The United States:

I’m over 50 and looking to reduce my current premium of $850 how much will it be after the reduction? I’ve been driving 30 years without any accidents or tickets; currently own 3 cars (1 paid off) with 1 driver. Also, is this rate good for those who use their vehicle only on weekends?

How much is motorcycle insurance a month?

A 16-year-old male in Idaho can expect to pay an average of $105.76 per month for motorcycle insurance, according to insurance’s latest study. Some companies even charge as low as $20/month or less, which is just a fifth of the average rate that other insurers are charging.

“Although the image of motorcycles speeding along highways may bring thoughts of high risk and exorbitant premiums, many motorcycle owners are actually paying significantly lower rates than their car-driving counterparts,” says Mark Romano, senior vice president at insurance. “This is especially true for younger riders.”

The national monthly average cost for motorcycle insurance was determined by looking at the rates charged by the nation’s largest insurers with at least a 15 per cent market share.

The national monthly average cost for motorcycle insurance climbed to $105.76, an increase of about 42 cents compared with last year.

“Motorcycle owners ages 21-25 can expect to pay the most each month; those same drivers would have paid an average of $230.28 per month just five years ago,” Romano adds. “Meanwhile, riders in the two youngest age groups – 19- and 20-year-olds – are now paying much less than they were three or four years ago.”

How much is motorcycle insurance for a 17-year-old?

I was wondering how much it would be to get motorcycle insurance for someone who is 17 years old. I’m beginning to look around at prices because I’m interested in getting one within the next year or two.

What’s your zip code? What type of bike (make, model, year)?

I live in Texas and want a new Kawasaki Ninja 300 ABS.

The average cost of a 16-year-old male motorcyclist’s insurance: is $1,994 per year ($166 monthly)>.

Source: InsuranceQuotes.com February 2013 data based on up to six family members on a policy with state minimum coverage including bodily injury protection of $25,000 for one person/$50,000 for all injured in an accident, $15,000 for property damage, and $50,000 in UM/UIM coverage.

Source: Progressive Rates (based on customer feedback)

May 2009 – January 2010 (for a Ninja 300 ABS)

- $738 ($59 per month) on parents’ car insurance with no claims or discounts.

- $1,202 ($99 per month) on parents’ car insurance with one claim in last five years and clean driving record.

- $1,452 ($120 per month) on parents’ car insurance with three claims in last five years and clean driving record.

- $2,086 ($175 per month) on parents’ car insurance with five claims in last five years and clean driving record.

Note: Each condition is based on the parent’s car insurance policy premium for a 16-year-old male with no discounts or claims, which allows about $1,000 per year of premiums to be assigned to motorcycle coverage.

Source: California Casualty Motorcycle Insurance Rates (based on customer feedback)

January 2009 – January 2010 (for a Ninja 300 ABS)

- $2,259 ($189 per month) on parents’ car insurance with no claims or discounts.

- $3,186 ($262 per month) on parents’ car insurance with one claim in the last three years and clean driving record.

- $4,021 ($341 per month) on parents’ car insurance with two claims in last three years and clean driving record.

- $5,710 ($472 per month) on parents’ car insurance with three claims in last three years and clean driving record.

Source: Hagerty Motorcycle Insurance Rates (based on customer feedback)

November 2011 – January 2012 (for a Ninja 300 ABS)

- $738 ($59 per month) on parents’ car insurance with no claims.

- $1,130 ($91 per month) on parents’ car insurance with one claim in last five years.

- $1,992 ($162 per month) on parents’ car insurance with two claims in last five years.

- $2,564 ($202 per month) on parents’ car insurance with three claims in last five years.

Note: Each condition is based on the parent’s car insurance policy premium for a 16-year-old male with no discounts or claims, which allows about $1,000 per year of premiums to be assigned to motorcycle coverage. Additional cost factors are age/experience level of driver and estimated distance drove each year.

Source: Progressive (based on customer feedback)

April 2010 (for a Ninja 300 ABS)

- $2,070 ($164 per month) on parents’ car insurance with no claims or discounts.

- $3,442 ($276 per month) on parents’ car insurance with one claim in last five years and clean driving record.

- $4,521 ($355 per month) on parents’ car insurance with two claims in last five years and clean driving record.

- $6,114 ($490 per month) on parents’ car insurance with three claims in last five years and clean driving record.

Source: GEICO (based on customer feedback)

May 2012 – January 2013 (for a Ninja 300 ABS)

- $2,535 ($202 per month) on parents’ car insurance with one claim in last three years or clean driving record for the past six years.

- $3,708 ($297 per month) on parents’ car insurance with two claims in last three years or five claims in the past six years.

- $4,890 ($365 per month) on parents’ car insurance with three claims in last three years or seven claims in the past six years.

How much is motorcycle insurance for a 18-year-old?

Allstate Insurance Company

Between $150-200 for collision and $450-600 for comprehensive coverage per six-month policy period, depending on many factors including the type of motorcycle you drive, your age, driving record, etc. You can call Allstate at 1-866-726-4 or by visiting an agent near you today to learn more about their low-cost motorcycle insurance plans.

Motorcycle Insurance Quote from Progressive

Progressive offers many types of coverage as well as discounts that could help lower costs as well as provide protection options tailored specifically to be right for your needs. To find out how it would cost for you personally, call 1-800-925-2or visit Progressive.com to get a free motorcycle insurance quote today.

Average motorcycle insurance cost for a 19-year-old?

I’m 19 and will be getting my motorcycle license soon. I want to buy a bike but don’t know how much insurance would cost me.

Well, it depends on where you live, what year the bike is, how valuable it is, etc…etc…hope this helps.

The average 19-year-old male pays about $500/6 months for liability only. Check out Progressive’s website at http://www.progressive.com Or call around to different insurance agents that sell motorcycle insurance. best of luck!

How much is motorcycle insurance a month?

Some companies even charge as low as $20/month or less, which is just a fifth of the average rate that other insurers are charging.

“Although the image of motorcycles speeding along highways may bring thoughts of high risk and exorbitant premiums, many motorcycle owners are actually paying significantly lower rates than their car-driving counterparts,” says Mark Romano, senior vice president at insurance. “This is especially true for younger riders.”

The national monthly average cost for motorcycle insurance was determined by looking at the rates charged by the nation’s largest insurers with at least a 15 per cent market share.

The national monthly average cost for motorcycle insurance climbed to $105.76, an increase of about 42 cents compared with last year.

“Motorcycle owners ages 21-25 can expect to pay the most each month; those same drivers would have paid an average of $230.28 per month just five years ago,” Romano adds. “Meanwhile, riders in the two youngest age groups – 19- and 20-year-olds – are now paying much less than they were three or four years ago.”

Motorcycle Insurance Quote from Progressive

Progressive offers many types of coverage as well as discounts that could help lower costs as well as provide protection options tailored specifically to be right for your needs. To find out how it would cost for you personally, call 1-800-925-2or visit Progressive.com to get a free motorcycle insurance quote today.

Average motorcycle insurance cost for 19 year-old?

I’m 19 and will be getting my motorcycle licence soon. I want to buy a bike but don’t know how much insurance would cost me.

well it depends on where you live, what year the bike is, how valuable it is, etc…etc…hope this helps

The average 19-year-old male pays about $500/6 months for liability only. Check out Progressive’s website at http://www.progressive.com Or call around to different insurance agents that sell motorcycle insurance. best of luck!

How much is motorcycle insurance for a 20-year-old?

The average monthly premium for motorcycle insurance in the US is .43 which equals 5.92 per year.

Average motorcycle insurance cost for a 21-year-old male living in new york!

To get an accurate idea, I looked up quotes for my 21-year-old brother who just moved to New York City after finishing his undergraduate degree.

His 2012 Kawasaki Ninja was given a quote of 0 per month for full coverage with no accidents or violations on his record. He has his motorcycle endorsement and motorcycle license, but he has never driven in an accident or had any violations.

Motorcycle insurance for a 21-year-old living in new york city!

So, I went to GEICO’s website and put in the same information for my 16-year-old self (no accidents/moving violations), and got a quote of $226 for one year of coverage and $2360 for five years.

How Much Is Moped Insurance For 17 Year Old?

Many American teenagers also see driving as an essential rite of passage into adulthood. Whether or not they actually need or want a car, many teens are determined to get their driver’s license as soon as they are eligible. But this goal is not always easy, since insurance can be very expensive. And depending on where you live, the rules vary by age and may require specific courses or an advanced test called a road test.

If you plan on financing a car for your teen, it’s not too early to start comparing car insurance prices.

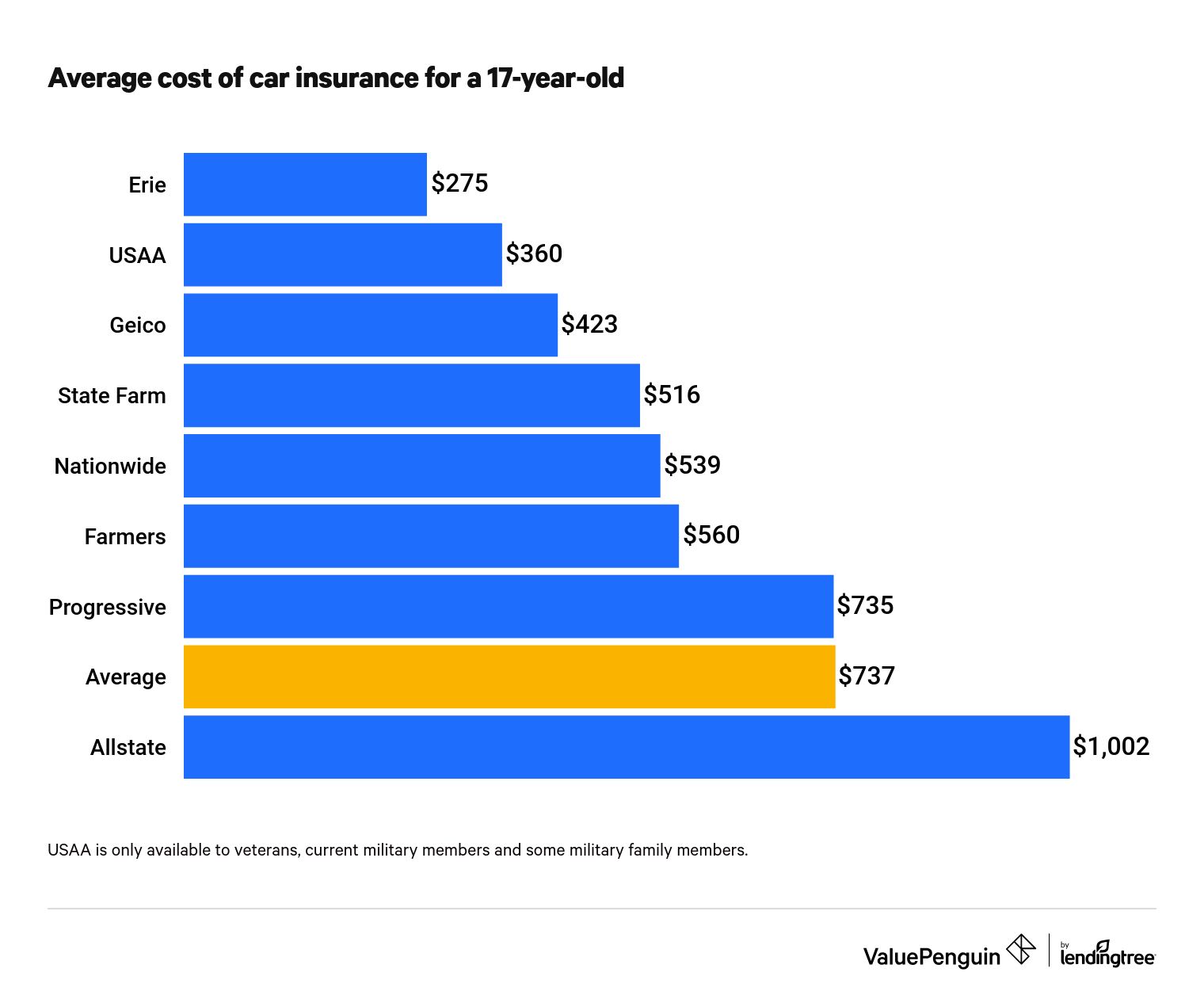

Insurance companies charge different rates for teens because they are sometimes involved in more accidents than older drivers. Teenagers are more likely to speed, tailgate, pass on the shoulder of the road, and use cell phones while driving; all of which can cause accidents. The following is a list of car insurance quotes for teenagers, along with the average cost of car insurance in your state.

INSURANCE RATES FOR TEENS:

National: $5,500/year ($415/month).

State: Alaska – $6,900/year ($530/month); New York- $4,244/year ($333);

This answer is based on a national average of car insurance rates for teens.

The amount you pay will vary depending on your driving record and the location where you live.

If you have recently moved to a new state or city, call an insurance agent and explain that you’re shopping around for the best rates. Before you start that search, however, be sure you understand how car insurance works and what factors into your premiums.

The amount of money you pay in premiums depends primarily on:

- Your age (typically the younger, the better).

- The make and model of your car (the more expensive or sportier, the more you’ll pay).

- Your driving record (clean for the least amount of money).

- The number of miles you drive each year.

- Whether or not you have had an accident in the past few years. If so, how bad was it? What were the damages?

You can save money on insurance by:

- Carpooling and taking public transportation (this could also benefit you academically).

- Wearing your seat belt and driving the speed limit (both save lives, which saves money for everyone).

- Checking with your parents to make sure they have stable jobs and good health insurance. This way, if they’re in a car accident, you won’t be forced to pay their bills.

- Taking a defensive driving course.

- Putting your teenager on your car insurance policy (if allowed by state law) or adding him/her as an additional driver. If you decide to add them, make sure there is no other driver on the policy, as the car is usually considered a family car.

- Assuming more responsibility like getting a part-time job or participating in community service. If you earn enough money, your parents may be able to drop their collision and comprehensive coverage on your vehicle.

- Keep shopping around for insurance rates; rates vary greatly among insurers.

The bottom line is that fencing your child into his or her room until they are 35 won’t work. Teenagers will still find a way to drive if that is what they want to do. By helping your teens understand how car insurance works, the reality of the cost associated with it, and steps they can take to reduce their car insurance premiums, you are giving them a vital life skill and teaching them to be smart with their money.