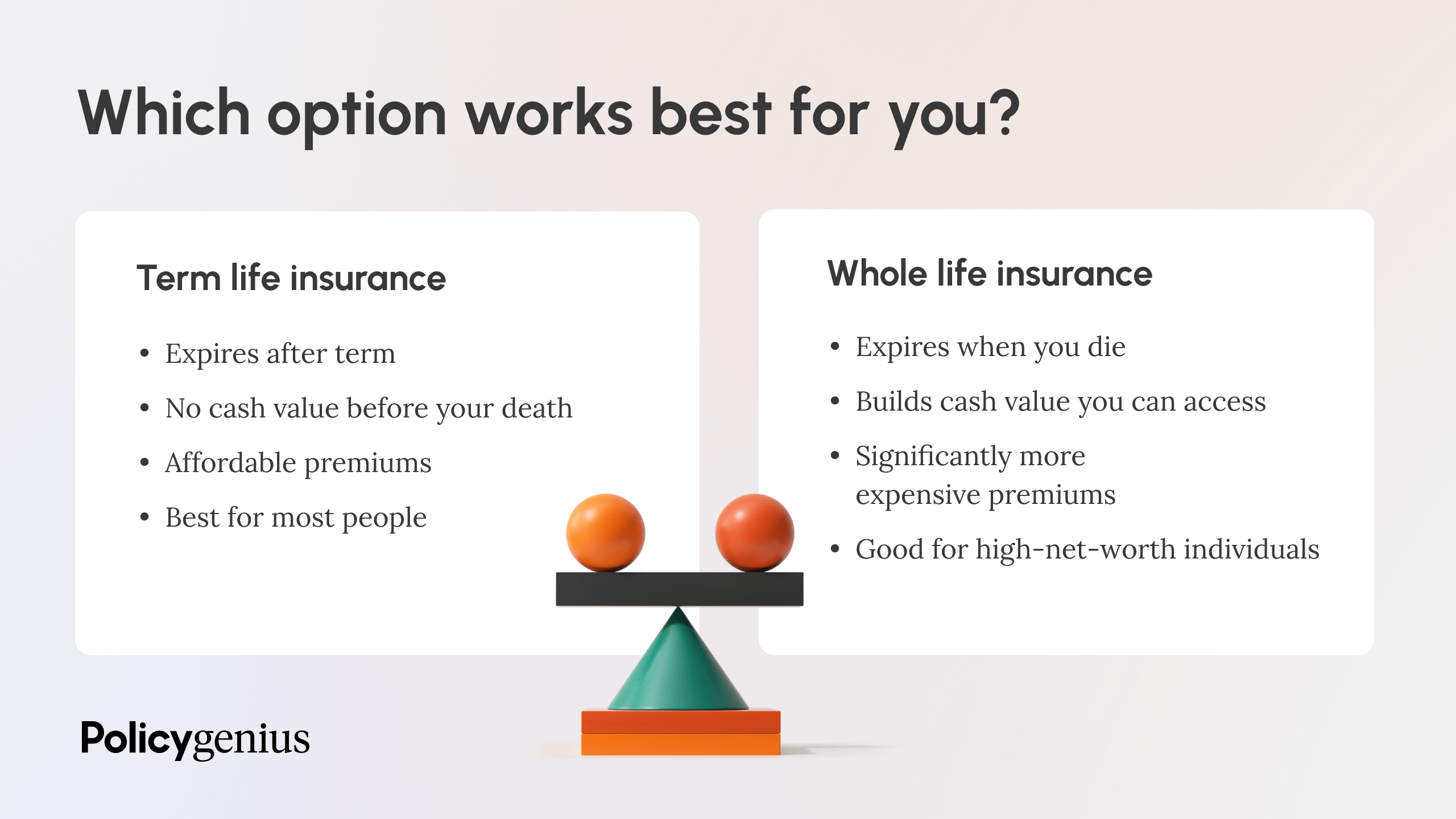

Whole life insurance offers lifelong coverage with a cash value component, while term life insurance provides coverage for a specific term. Both types of insurance have unique features that cater to different financial needs.

Understanding the differences between whole life and term life insurance can help individuals make informed decisions about their insurance coverage. Whole life insurance typically has higher premiums but offers lifelong coverage and a cash value component that can be used as an investment or savings tool.

On the other hand, term life insurance is more affordable and provides coverage for a specific period, making it a popular choice for those looking for temporary coverage or a lower premium option. Deciding between whole life and term life insurance depends on individual financial goals and needs.

Credit: www.policygenius.com

Table of Contents

Cost

Initial Premiums: Whole life insurance typically has higher initial premiums due to the cash value component. Term life insurance offers lower initial premiums.

Overall Cost Comparison Over Time: When considering the overall cost over time, term life insurance may be more cost-effective as it provides coverage for a specific period without the cash value component.

:max_bytes(150000):strip_icc()/dotdash-ask-answers-205-Final-7a1ca51b85d44e0d81dc7b46f919180d.jpg)

Credit: www.investopedia.com

Coverage Period

| Duration of Coverage for Whole Life Insurance | Duration of Coverage for Term Life Insurance |

| Whole life insurance provides coverage for the entire lifetime of the insured. | Term life insurance offers coverage for a specified period, such as 10, 20, or 30 years. |

Cash Value

Whole Life Insurance offers a cash value component that accumulates over time. This cash value can be utilized during the insured’s lifetime for various purposes, such as borrowing against it or surrendering the policy for its value. On the other hand, Term Life Insurance does not provide any cash value. It is designed to offer coverage for a specific term, without any savings component. Therefore, when considering a life insurance policy, it is essential to evaluate whether the cash value feature is a priority.

When comparing the two types of insurance, individuals should carefully assess their long-term financial goals and determine whether the cash value feature aligns with their needs. The decision between Whole Life and Term Life Insurance ultimately depends on the individual’s unique circumstances and financial objectives.

Credit: www.ramseysolutions.com

Investment Component

Whole life insurance offers investment opportunities in the form of a cash value component, which grows over time and can be borrowed against or withdrawn. This allows policyholders to potentially build wealth over the long term. On the other hand, term life insurance does not have an investment component. It provides pure death benefit coverage for a specific period of time without any cash value accumulation. Therefore, individuals looking for both protection and investment opportunities may find whole life insurance more suitable, while those primarily concerned with affordable coverage for a specific period may opt for term life insurance.

Flexibility

Comparing Whole Life Insurance to Term Life Insurance, one key aspect to consider is flexibility. Whole Life offers lifelong coverage and cash value accumulation, while Term Life provides temporary coverage for a specific period. The choice depends on your individual financial goals and needs.

| Flexibility: |

| Whole Life Insurance offers flexibility in premium payments. |

| Term Life Insurance lacks flexibility in premium payment options. |

Considerations

When deciding between whole life insurance and term life insurance, there are a few key considerations to keep in mind. Age and health factors play a significant role in determining which type of insurance is the best fit. For those who are younger and in good health, term life insurance may be a more affordable option. However, for those who are older or have underlying health conditions, whole life insurance may provide more comprehensive coverage.

Another important factor to consider is your financial goals and objectives. Whole life insurance policies offer a cash value component that can accumulate over time, making it a good option for those looking to build long-term savings. On the other hand, term life insurance policies do not have a cash value component but can provide more affordable coverage for a specific period of time.

| Considerations | Whole Life Insurance | Term Life Insurance |

|---|---|---|

| Age and Health Factors | May be a better fit for older individuals or those with underlying health conditions | May be a more affordable option for younger individuals in good health |

| Financial Goals and Objectives | Offers a cash value component that can accumulate over time, making it a good option for those looking to build long-term savings | Does not have a cash value component but can provide more affordable coverage for a specific period of time |

Frequently Asked Questions

Which Is Better, Whole Life Or Term Life Insurance?

Whole life insurance provides lifelong coverage with a cash value component, while term life insurance offers coverage for a specific period. Whole life may be better for long-term needs and investment, while term life is more affordable for temporary coverage.

Choose based on your financial goals and coverage needs.

What Are 2 Disadvantages Of Whole Life Insurance?

Two disadvantages of whole life insurance are higher premiums compared to term life insurance and limited investment flexibility.

Can You Cash Out Whole Life Insurance?

Yes, you can cash out whole life insurance policies, but it may have tax implications.

What Happens At The End Of Term Life Insurance?

At the end of term life insurance, coverage expires and the policy no longer provides protection. You can choose to renew, convert, or let the policy lapse. If you pass away during the term, your beneficiaries receive the death benefit.

Conclusion

In the end, the choice between whole life insurance and term life insurance depends on your specific needs and financial situation. Consider the duration of coverage, premium costs, and potential for cash value. Both types of policies offer unique benefits, so it’s essential to carefully weigh the pros and cons before making a decision.

With the right policy, you can ensure financial protection for your loved ones.