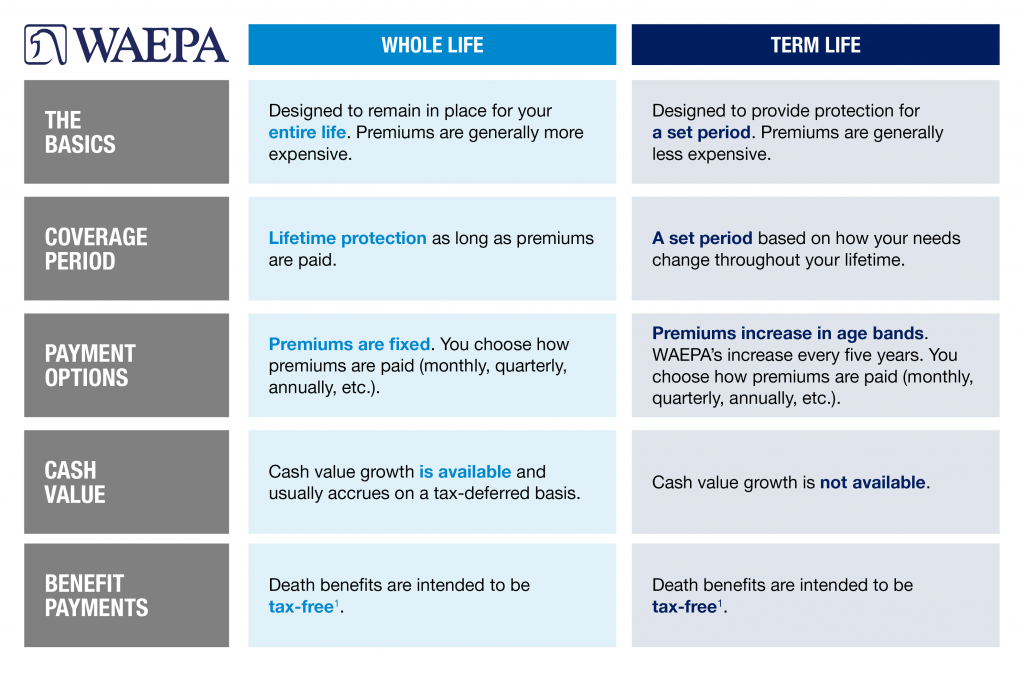

When it comes to life insurance, the options can feel overwhelming. In addition to the many different types of insurance available, the prospect of deciding on a level of coverage can be daunting as well. Today, we’ll help you understand the difference between whole life and term life insurance, and which one makes the most sense for your financial situation.

Table of Contents

What is Whole Life Insurance?

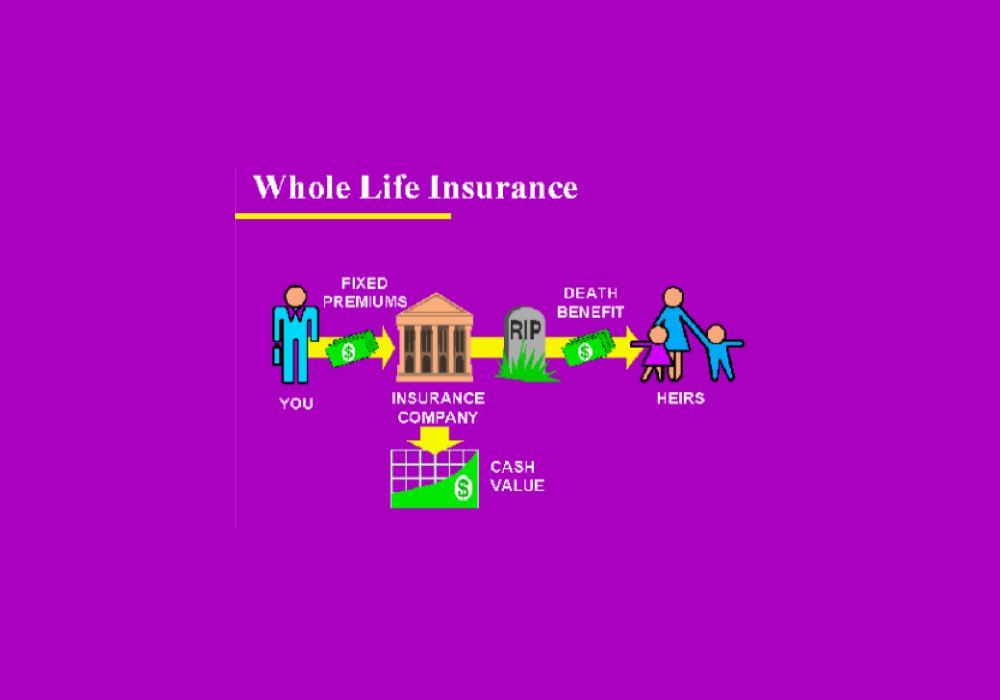

Generally, whole life insurance is a long-term coverage option that pays a death benefit until the policyholder is age 100 and beyond. At the time of death, the death benefit is the only payment the policyholder receives. The death benefit is paid on a regular basis, like a regular insurance policy would pay.

However, a whole life insurance policy has one other big difference: the death benefit is guaranteed. This means that, regardless of how old you are and how healthy you are at the time of your death, the death benefit will be paid to whoever you designate to receive it.

What is Term Life Insurance?

With term life insurance, premiums are paid for a specific period of time. This can range from 10 years to the policyholder’s lifetime. At the end of the term, the policyholder either makes the decision to keep the coverage or cancels the policy and stops paying the remaining premiums.

Most term policies only have one term, meaning a 10 or 20-year time frame, but some have multiple terms. Term life insurance policies generally have lower death benefit amounts, while also having lower premiums. This is because the death benefit isn’t as large as it is with whole life insurance. This means that, if the policyholder were to die during the term of a policy, the policy would end right then and there, with the remaining premium amount owed.

Whole Life vs. Term Life: Which One Is Right for You?

If you’re considering whole life insurance, you may want to think about another option in addition to your current coverage. It’s important to understand the pros and cons of each type of coverage so you can make an informed decision about which type is best for you.

When choosing which type of life insurance makes the most sense for you, there are a few things to consider. First, it’s important to understand what you want from your policy. Do you want a high death benefit? Do you want to pay low premiums?

Once you understand what you want, you can start to look at the differences between whole life and term life insurance to determine which one is best for you. First, let’s take a look at what a whole life insurance policy is and what it provides.

Other Types of Insurance to Consider

Besides whole life and term life insurance, you may also want to consider other types of insurance that provide different coverage and benefits. If you have other family members or loved ones that you want to protect, you may want to consider a joint life or universal life policy.

Joint life insurance can pay off the death benefit of another person if you die or pay off the remaining premiums of another person if they die. The death benefit of a joint life insurance policy ranges from $250,000 to $500,000, depending on the type of policy you choose.

Universal life insurance is a type of term insurance that pays off the death benefit at a specific age. This means that you only pay one set amount each month for the entire length of the policy. The cost of a universal life policy can vary, but is typically cheaper than a traditional term policy.

Bottom Line

While each type of life insurance has its strengths, whole life insurance can provide a death benefit that is very difficult to match with other types of insurance. If you’re looking for a way to protect your assets against the risk of death, you may want to consider a whole life policy.

Whether you’re looking to protect your family or your future financial security, a whole life policy can provide the death benefit you need. Now that you know what whole life is and what it provides, it’s time to figure out if it’s right for you and your circumstances.

4 Comments