Mobile home insurance policies and rates vary based on factors such as location, age of the home, and coverage options. Understanding the specific needs of your mobile home and comparing quotes from different insurers can help you find the best policy at a competitive rate.

Mobile home insurance provides protection for your home, personal property, and liability, offering peace of mind in case of unexpected events. It’s essential to review the details of the policy to ensure adequate coverage for your unique circumstances. By researching and comparing options, you can secure the right insurance policy to safeguard your mobile home and belongings.

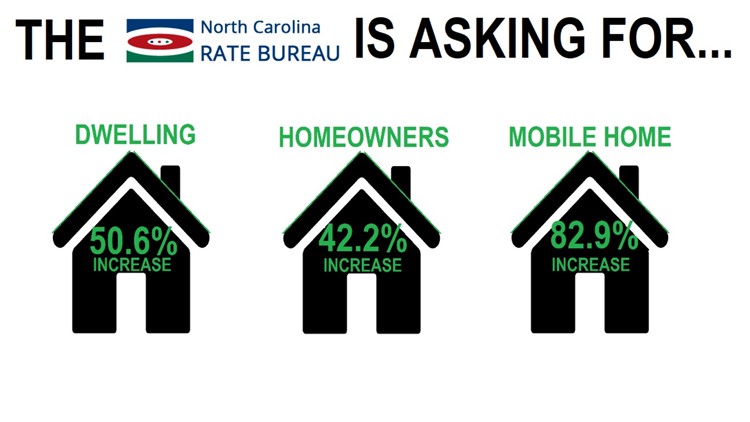

Credit: www.wfmynews2.com

Table of Contents

Types Of Mobile Home Insurance Policies

Basic Coverage: This type of mobile home insurance policy typically includes protection against damage from fire, theft, and vandalism. It may also cover personal property and liability in case someone is injured on your property.

Comprehensive Coverage: Comprehensive policies offer broader protection, including coverage for natural disasters, such as floods and earthquakes. Additionally, it may include coverage for additional living expenses if your home becomes uninhabitable.

Liability Coverage: Liability coverage protects you in the event someone is injured on your property and you are found to be at fault. This coverage can also help with legal expenses if you are sued due to an incident on your property.

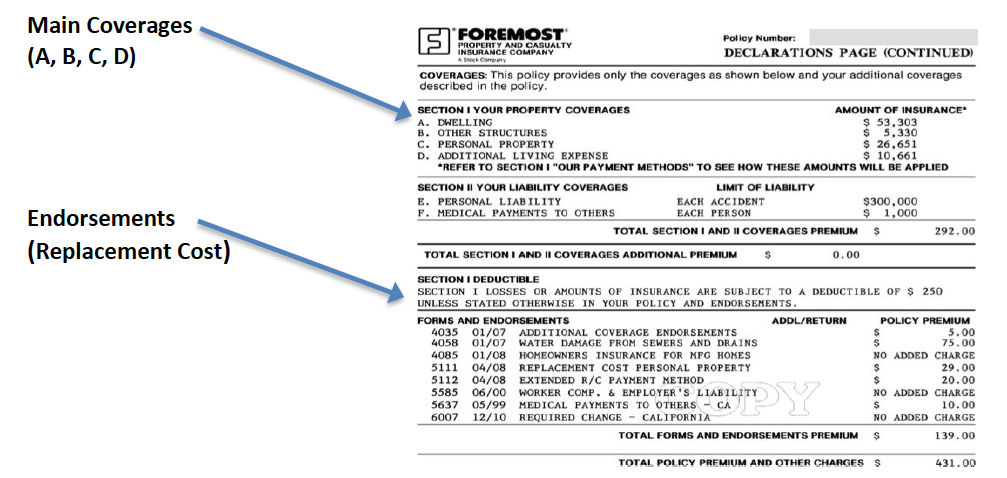

Credit: www.foremost.com

Factors Affecting Mobile Home Insurance Rates

Location: The location of your mobile home plays a significant role in determining your insurance rates. Homes in high-risk areas, such as those prone to natural disasters, may have higher premiums.

Age of Home: The age of your mobile home can impact your insurance rates. Older homes may cost more to insure due to the increased risk of structural issues.

Value of Home: The value of your mobile home directly affects your insurance rates. Higher valued homes typically require higher coverage limits, resulting in higher premiums.

Deductible: Choosing a higher deductible can lower your insurance rates, but it’s important to ensure you can afford the out-of-pocket expense in the event of a claim.

Claims History: Your past claims history can influence your insurance rates. A history of frequent claims may lead to higher premiums, while a clean claims record can result in lower rates.

Ways To Lower Your Mobile Home Insurance Rates

Increasing Deductible: One way to lower your mobile home insurance rates is by increasing your deductible. By opting for a higher deductible, you can reduce your premiums.

Bundling Policies: Bundling your mobile home insurance with other policies, such as auto insurance, from the same provider can lead to discounts on your premiums.

Installing Safety Features: Installing safety features like smoke alarms, deadbolts, and security systems can make your home safer and potentially lower your insurance rates.

Maintaining Good Credit Score: Maintaining a good credit score can also help in lowering your mobile home insurance rates, as insurers often consider credit history when determining premiums.

Credit: uphelp.org

Top Mobile Home Insurance Providers

Mobile home insurance policies can vary widely depending on the provider. When comparing top mobile home insurance providers, it’s important to consider the coverage and rates offered by each. Company A provides comprehensive policies tailored to mobile homeowners, including coverage for structures and personal property. Company B offers competitive rates and customizable policies to meet individual needs. Company C stands out for its exceptional customer service and quick claims processing. When selecting a mobile home insurance provider, it’s crucial to assess the level of coverage, rates, and customer support to ensure the best protection for your home.

How To Choose The Best Mobile Home Insurance Policy

Choosing the best mobile home insurance policy can be a daunting task, but it is essential to ensure that your home is protected. Here are some tips to help you make the right choice:

Compare Rates

Compare rates from different insurance providers to find the best deal. Look for discounts and special offers that can help you save money.

Read Reviews

Read reviews from other mobile homeowners to see their experiences with different insurance providers. This can help you identify any potential problems or issues with a particular provider.

Check Coverage

Check the coverage offered by different policies to ensure that they meet your needs. Make sure that the policy covers any damages or losses that you may face.

Ask Questions

Ask questions to the insurance provider to clarify any doubts or concerns that you may have. Make sure that you understand the terms and conditions of the policy before signing up.

By following these tips, you can choose the best mobile home insurance policy that provides the coverage you need at a price you can afford.

Frequently Asked Questions

What Is Best Insurance Company For Mobile Home?

The best insurance company for mobile homes is State Farm, offering comprehensive coverage and excellent customer service.

Why Is It Harder To Insure A Manufactured Home?

Manufactured homes are harder to insure due to higher risk of damage and depreciation. Limited resale value and construction quality impact insurance availability and rates.

What Makes A Mobile Home Uninsurable?

Mobile homes can be uninsurable due to age, poor maintenance, location in high-risk areas, or non-compliance with safety standards.

What Is A Mobile Home Insurance Policy Most Similar To?

A mobile home insurance policy is most similar to a traditional homeowner’s insurance policy. Both provide coverage for the structure and personal belongings.

Conclusion

As you navigate the world of mobile home insurance, be sure to compare policies and rates. Protecting your investment is crucial. Understanding the different coverage options can save you money in the long run. Secure your mobile home with the right insurance policy today.