Mobile home insurance in tornado-prone areas is crucial for protecting your property and belongings. It provides financial coverage in case of tornado-related damages.

Living in an area prone to tornadoes increases the risk of property damage, making insurance a necessity. Mobile homes are particularly vulnerable to tornadoes due to their structure, so having the right insurance coverage is essential for peace of mind.

In the event of a tornado, having insurance can help you recover and rebuild without facing significant financial burdens. Understanding the specifics of mobile home insurance in tornado-prone regions is key to ensuring you have adequate protection for your valuable assets.

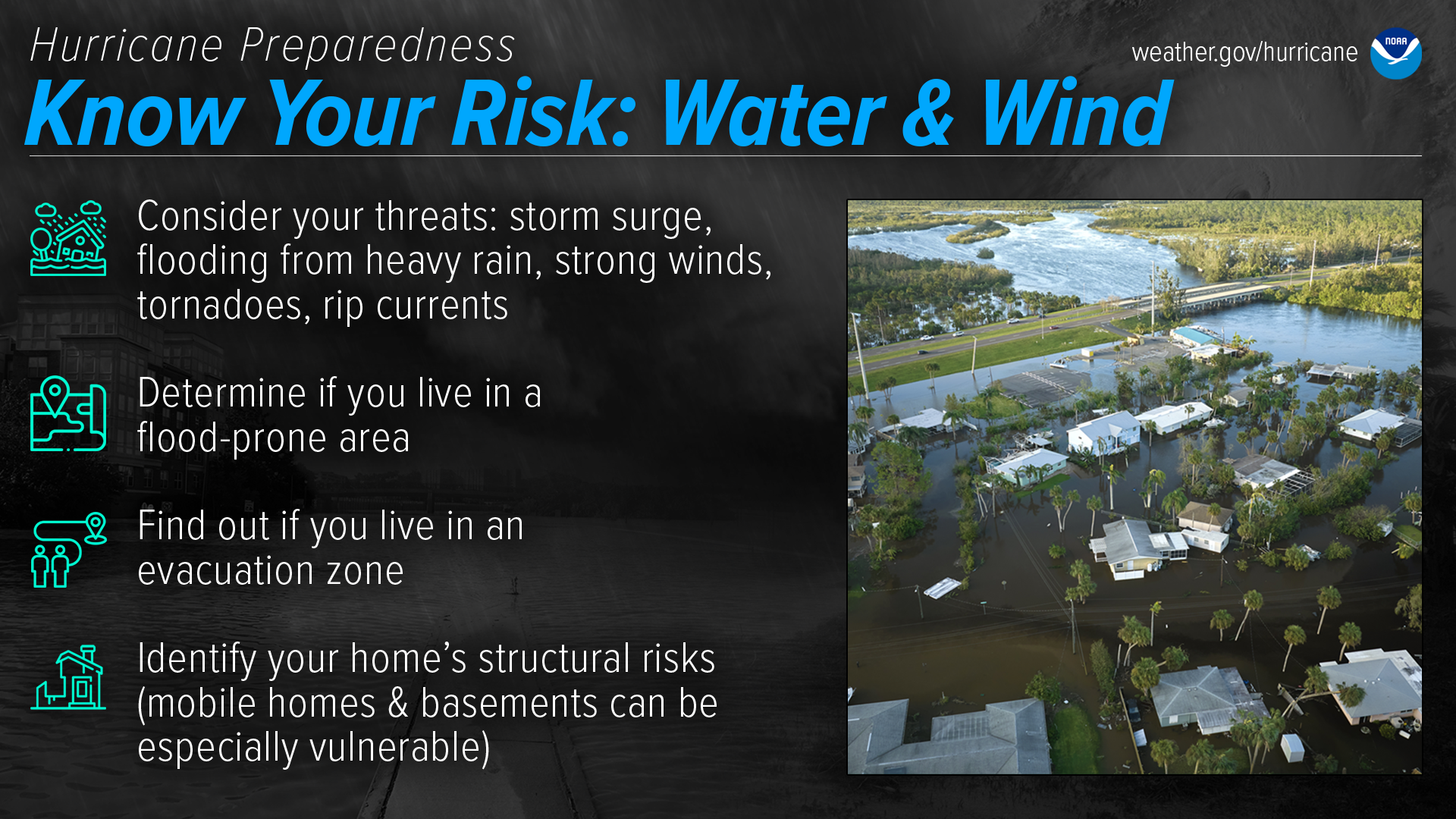

Credit: www.weather.gov

Table of Contents

The Importance Of Mobile Home Insurance

Mobile home insurance is crucial, especially in tornado-prone areas. Insurance provides financial protection against potential disasters. It covers damages to the structure and belongings. Mobile homes are vulnerable to severe weather conditions. Insurance mitigates the risks and offers peace of mind. Without insurance, owners face significant financial losses. Coverage ensures the ability to rebuild or replace property. It is essential to understand the risks associated with mobile home ownership. Insurance safeguards against unforeseen events, providing a safety net for homeowners.

Understanding Tornadoes In Tornado-prone Areas

Mobile home insurance in tornado-prone areas is crucial for protecting your property. Understanding tornadoes is essential to grasp the risks involved. Tornadoes are violent windstorms characterized by a twisting, funnel-shaped cloud. Factors that contribute to tornadoes in tornado-prone areas include warm, moist air colliding with cool, dry air. Additionally, the presence of mountains or hills can enhance tornado formation. It’s important to be aware of the specific risks in your area and ensure your insurance policy provides adequate coverage for tornado damage.

Assessing Your Mobile Home Insurance Needs In Tornado-prone Areas

When evaluating mobile home insurance needs in tornado-prone areas, consider the value of your mobile home. Assess its current market worth and potential replacement cost to ensure adequate coverage.

Explore coverage options for mobile home insurance in tornado-prone areas. Look for policies that offer protection against tornado damage, including structural and personal property coverage.

Credit: www.wowktv.com

Choosing The Right Mobile Home Insurance Provider

When selecting an insurance provider for mobile homes in tornado-prone areas, it’s crucial to consider several factors. First, compare the coverage options offered by different providers and ensure they include protection against tornado damage. Additionally, evaluate the financial stability and reputation of the insurance company to guarantee they can fulfill their obligations in the event of a disaster. It’s also important to inquire about any specific tornado-related provisions in their policies, such as coverage for temporary housing in the aftermath of a tornado. Ask insurance providers about their claims process and response time in emergency situations to ensure a smooth experience if the need arises. By carefully considering these factors, you can select the right mobile home insurance provider that offers comprehensive protection in tornado-prone areas.

Preparing For Tornadoes In Tornado-prone Areas

Living in a tornado-prone area means you need to be prepared for unexpected disasters. Creating a tornado emergency kit can help you stay safe and comfortable during and after the storm. Remember to include essentials like non-perishable food, water, a first aid kit, flashlights, and batteries in your kit. Developing a tornado safety plan is also crucial. Make sure everyone in your household knows where to go during a tornado and how to stay safe. Stay informed about the weather conditions by monitoring local news and weather alerts. Don’t wait until the last minute to prepare for a tornado – take action now to protect yourself and your loved ones.

| Essential items for a Tornado Emergency Kit: |

|---|

| Non-perishable food |

| Water |

| First Aid kit |

| Flashlights |

| Batteries |

Filing A Mobile Home Insurance Claim After A Tornado

In tornado-prone areas, filing a mobile home insurance claim after a tornado is crucial. Contact your insurance provider immediately to report the damage and initiate the claims process. Provide all necessary documentation and cooperate with the adjuster to ensure a smooth resolution.

| Filing a Mobile Home Insurance Claim after a Tornado |

| After a tornado, contact your insurance company immediately. |

| Document the damage with photos or videos for evidence. |

| Provide detailed information about the damage to your insurer. |

| Keep receipts for temporary repairs or accommodations. |

| Follow up with your insurer on the claim status regularly. |

Tips For Maintaining Your Mobile Home In Tornado-prone Areas

Regular maintenance of your mobile home in tornado-prone areas is crucial. Inspect the roof for any damage and repair any leaks immediately. Secure loose siding and skirting to prevent wind damage. Trim trees and bushes near your home to reduce debris during a tornado. Check your insurance policy to ensure adequate coverage for tornadoes. Install storm shutters or reinforced doors and windows for added protection. Create an emergency plan and practice it with your family regularly. Consider investing in a weather radio for early warnings. Stay informed about tornado risks in your area and be prepared to take shelter when needed.

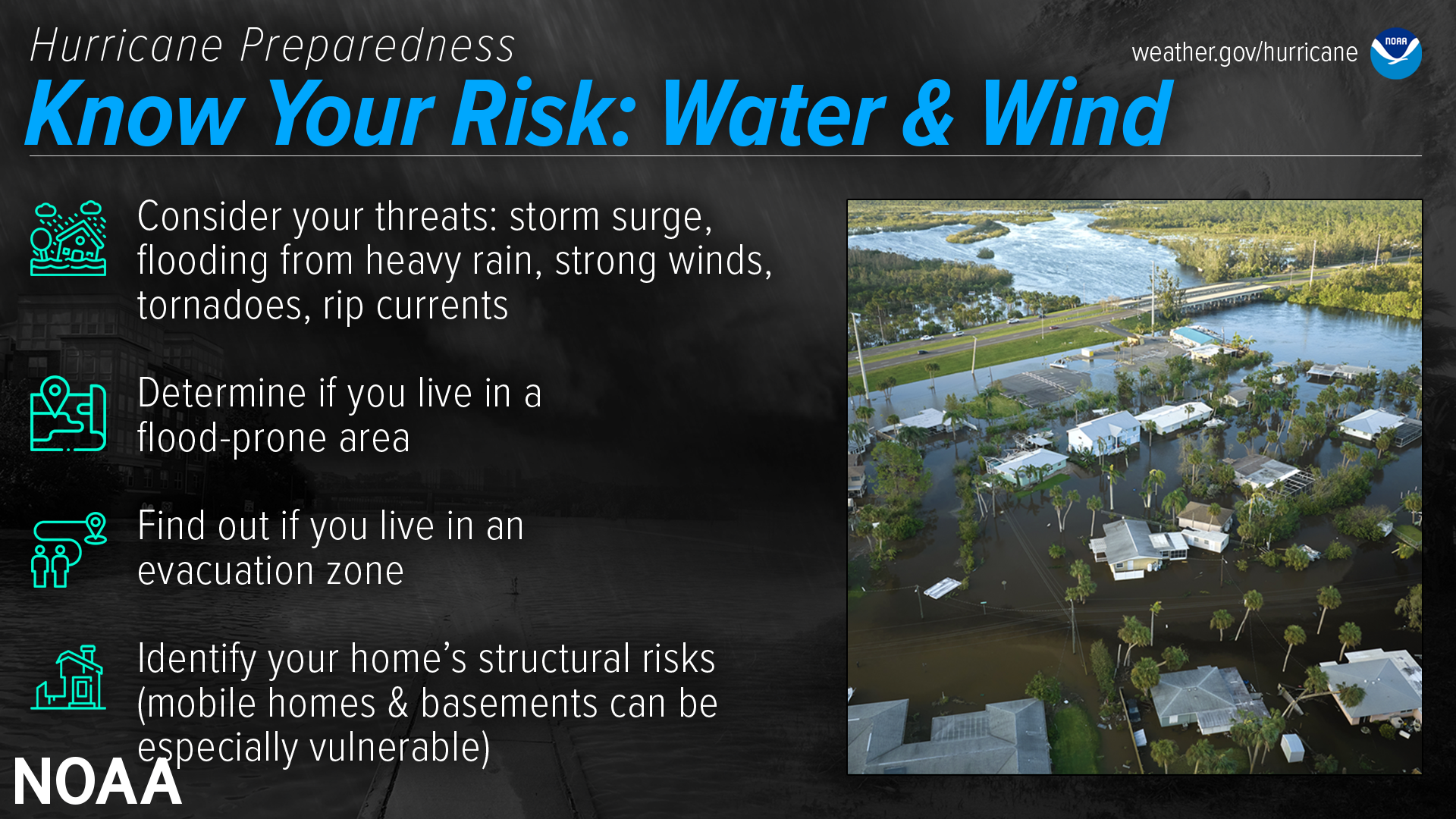

Credit: www.weather.gov

Frequently Asked Questions

Why Is It Harder To Insure A Manufactured Home?

Manufactured homes are harder to insure due to higher risk of damage and depreciation. Limited resale value impacts coverage options.

What Are The Disadvantages Of Owning A Mobile Home?

Disadvantages of owning a mobile home include limited resale value, potential for depreciation, park restrictions, and financing challenges.

Are Mobile Homes Safe In Storms?

Yes, mobile homes can be safe in storms with proper anchoring and reinforcements. Regular maintenance and following safety guidelines are crucial. Seek sturdy options when purchasing.

What Is A Mobile Home Insurance Policy Most Similar To?

A mobile home insurance policy is most similar to a traditional homeowners insurance policy.

Conclusion

Securing mobile home insurance in tornado-prone areas is crucial for protecting your investment and ensuring peace of mind. By understanding the specific coverage options available and working closely with knowledgeable insurance providers, you can safeguard your home and belongings against potential tornado-related damages.

Stay informed, stay protected.