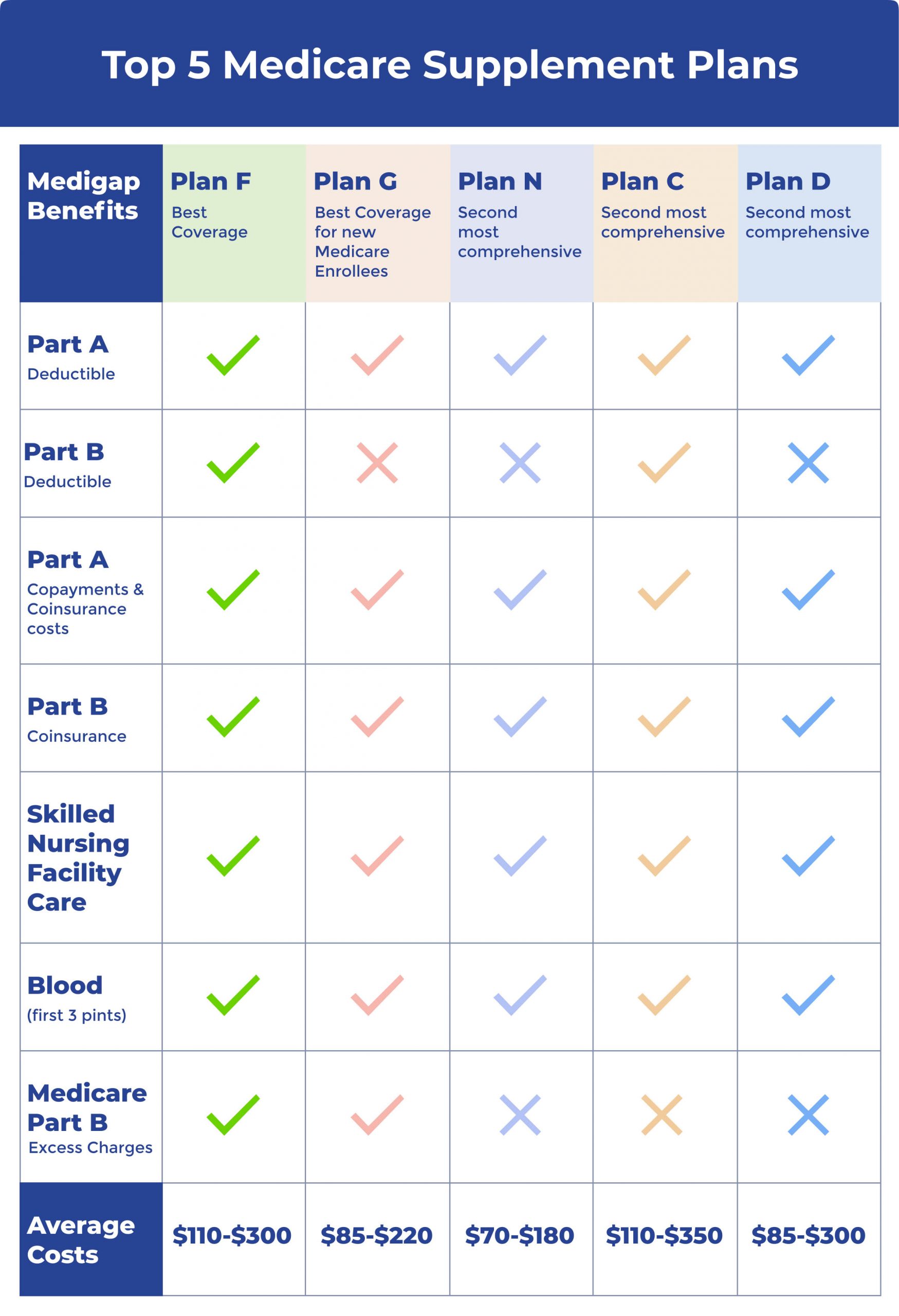

Medigap policies provide additional coverage for retirees over 70, filling gaps in Medicare benefits. These policies can help cover out-of-pocket costs not covered by Medicare, giving retirees peace of mind.

As retirees age, their healthcare needs may increase, making Medigap policies a valuable asset in ensuring comprehensive coverage. Understanding the options available and selecting the right policy is essential for retirees to make informed decisions about their healthcare coverage. By exploring the various Medigap plans, retirees can find the one that best suits their individual needs and budget, providing financial protection and access to necessary medical services.

Considering factors such as premiums, coverage options, and provider networks can help retirees navigate the complexities of Medicare and Medigap policies effectively.

Credit: www.myseniorhealthplan.com

Table of Contents

What Are Medigap Policies?

Medigap Policies are supplemental insurance plans designed to cover the gaps in Medicare coverage for retirees over 70. These policies help pay for some of the health care costs that Medicare doesn’t cover, such as copayments, coinsurance, and deductibles. Medigap policies are sold by private insurance companies and work alongside Original Medicare to provide additional financial protection for retirees. They are not meant to provide stand-alone coverage and cannot be used to pay for Medicare Advantage Plan costs. It’s important for retirees to compare the benefits and costs of different Medigap policies before choosing one that suits their needs.

Why Medigap Policies Are Important For Retirees Over 70

Retirees over 70 should consider Medigap policies to bridge the coverage gaps in Medicare. With rising healthcare costs, it provides peace of mind and financial security. Medicare doesn’t cover all medical expenses, leaving retirees vulnerable to unexpected bills. Medigap policies help cover expenses such as co-payments, deductibles, and other out-of-pocket costs. It ensures retirees have access to the healthcare they need without worrying about the financial burden. By understanding the importance of Medigap policies, retirees can safeguard their health and finances during their retirement years.

Choosing The Right Medigap Policy

Medigap Policies for Retirees Over 70

Choosing the Right Medigap Policy

Understanding the Different Plans

Factors to Consider

Comparing Costs

Credit: boomerbenefits.com

Enrolling In A Medigap Policy

Enrolling in a Medigap Policy: When turning 65, the Open Enrollment Period is the best time to apply. During this period, insurers cannot deny coverage or charge higher premiums based on health conditions. Guaranteed Issue Rights also provide protection against coverage denials or higher costs. However, if applying outside of the open enrollment period, Underwriting and Medical Underwriting may come into play. Underwriting involves the assessment of health conditions and can lead to higher premiums or coverage denials. It’s crucial to understand these factors when enrolling in a Medigap policy as a retiree over 70.

Maximizing Coverage With Medigap Policies

Retirees over 70 may find that they need additional coverage beyond what Original Medicare offers. That’s where Medigap policies come in. By filling in coverage gaps and reducing out-of-pocket costs, Medigap policies can help ensure that retirees have the coverage they need.

Using Medigap With Other Insurance

Retirees who have other insurance coverage, such as through a former employer or a spouse’s employer, can still benefit from a Medigap policy. Medigap policies can help cover costs that other insurance may not, such as deductibles and coinsurance.

Filling In Coverage Gaps

Original Medicare may not cover all of a retiree’s healthcare needs, leaving gaps in coverage. Medigap policies can help fill those gaps by covering costs such as deductibles, coinsurance, and copayments.

Reducing Out-of-pocket Costs

Retirees may face significant out-of-pocket costs for healthcare services, even with Medicare coverage. Medigap policies can help reduce those costs by covering some or all of the expenses that Medicare doesn’t cover.

Credit: www.medigap.com

Common Concerns And Misconceptions About Medigap Policies

Medigap policies for retirees over 70 are essential for covering gaps in Medicare. Pre-existing conditions are covered without penalty. Coverage outside the U.S. is limited but can be beneficial. Losing coverage due to certain circumstances can be tricky, so understanding the rules is crucial.

Expert Tips And Advice

Working with a Medigap expert can help you navigate the complex world of insurance. Stay informed about policy changes to ensure you have the coverage you need. Planning for the future is key to peace of mind during retirement. Remember, a Medigap policy can provide additional coverage not offered by Medicare alone.

Frequently Asked Questions

What Is The Downside To Medigap Plans?

The downside to Medigap plans is the cost and lack of coverage for prescription drugs. Additionally, not all doctors accept Medigap.

Are Medigap Policies Being Phased Out?

No, Medigap policies are not being phased out. They continue to be available for Medicare beneficiaries.

Is There An Age Limit For Medigap?

There is no specific age limit for enrolling in Medigap plans, but it’s best to sign up during the open enrollment period to avoid higher premiums.

Do Medigap Plans Get More Expensive With Age?

Yes, Medigap plans generally become more expensive as you age. Premiums tend to increase over time.

Conclusion

Medigap policies are essential for retirees over 70 to bridge the gaps in their Medicare coverage. By offering additional benefits and coverage options, these policies provide financial security and peace of mind. It’s crucial for retirees to carefully consider their healthcare needs and choose a Medigap plan that best suits their individual circumstances.