Critical illness insurance for cancer provides coverage for medical expenses related to cancer treatment. It offers financial protection against the high costs of cancer care.

Cancer is a devastating illness that can impact anyone at any time. In such cases, having critical illness insurance can provide peace of mind and help alleviate the financial burden of treatment. This type of insurance typically covers various costs, including hospital stays, surgeries, chemotherapy, and other necessary treatments.

By investing in critical illness insurance for cancer coverage, individuals can focus on their recovery without worrying about the financial strain of medical bills. It serves as a valuable safety net during challenging times, ensuring that individuals can access the best possible care without financial constraints.

Credit: www.assurity.com

Table of Contents

The Importance Of Critical Illness Insurance

Critical Illness Insurance provides essential financial protection in the event of a cancer diagnosis. It ensures coverage for medical expenses and other related costs, offering peace of mind during a challenging time. This type of insurance can alleviate the financial burden of cancer treatment, allowing individuals to focus on their health and recovery. By having critical illness insurance, individuals can access the necessary resources without worrying about the associated expenses. In the case of cancer, this coverage can make a significant difference, providing support and security for both the patient and their family.

Understanding Critical Illness Insurance

What Does It Cover?

How Does It Work?

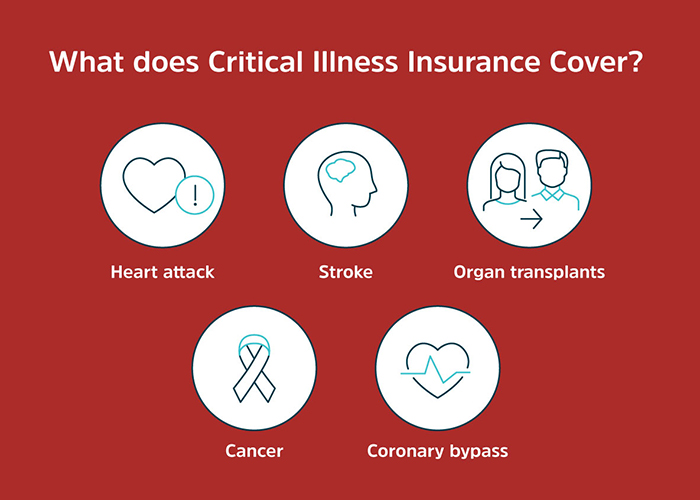

Critical illness insurance provides a lump sum payment upon diagnosis of a covered illness, including cancer. This coverage can help alleviate financial strain by providing funds to cover medical expenses, home modifications, and other costs. It typically covers major illnesses such as heart attack, stroke, and organ transplants, in addition to cancer. The policyholder receives the benefit if diagnosed with a covered illness, and the payout is typically tax-free. It’s important to carefully review the policy details to understand the specific illnesses covered and any exclusions. Critical illness insurance can complement traditional health insurance by providing additional financial support during challenging times.

Choosing The Right Policy

Critical illness insurance can provide valuable coverage for cancer patients. When choosing the right policy, it’s important to consider factors such as the coverage amount, waiting period, and premium cost. Comparing different plans can help you determine which one offers the best value for your specific needs. It’s essential to carefully review the policy details and exclusions to ensure that you have adequate coverage in the event of a cancer diagnosis. Additionally, understanding the claims process and the support services provided by the insurance company is crucial for making an informed decision. By weighing these factors, you can select a critical illness insurance policy that provides the necessary financial protection in the event of a cancer diagnosis.

Credit: deltabenefitsgroup.com

Benefits Of Critical Illness Insurance

Critical Illness Insurance can provide peace of mind for individuals diagnosed with cancer, as it offers financial support during a challenging time. This type of insurance provides a lump-sum payment upon diagnosis, which can be used to cover medical expenses, household bills, or any other needs that arise. Additionally, critical illness insurance offers additional support by providing a sense of security and the ability to focus on recovery without the worry of financial strain. This coverage can complement traditional health insurance and provide a safety net for unforeseen costs. It’s essential to consider critical illness insurance as a valuable tool in managing the financial impact of a cancer diagnosis.

Cost And Affordability

With critical illness insurance for cancer coverage, the cost and affordability are key considerations. This type of insurance offers financial protection in case of a cancer diagnosis, providing peace of mind without breaking the bank. It’s important to carefully compare plans to find the best coverage at a reasonable price.

| Cost and Affordability |

| Premiums and Payouts |

| Value for Money |

Credit: www.ailife.com

Filing A Claim

After receiving a diagnosis of cancer, filing a critical illness insurance claim can be overwhelming. The process typically involves three steps: notifying the insurer, submitting the necessary documents, and waiting for a decision. It is important to inform the insurer as soon as possible and to provide all required information and documentation.

Some tips for a smooth claim process include keeping organized records of medical bills and documentation, following up with the insurer if there are delays or questions, and seeking assistance from a trusted advisor or attorney if needed.

| Process Overview | Tips for a Smooth Claim |

|---|---|

| 1. Notify the insurer as soon as possible. | 1. Keep organized records of medical bills and documentation. |

| 2. Submit all required information and documentation. | 2. Follow up with the insurer if there are delays or questions. |

| 3. Wait for a decision from the insurer. | 3. Seek assistance from a trusted advisor or attorney if needed. |

Additional Considerations

Additional Considerations:

Critical illness insurance offers rider options to enhance coverage for cancer-related expenses. Understand renewal and cancellation policies to ensure continuous protection.

Frequently Asked Questions

Does Critical Illness Insurance Cover Cancer?

Yes, critical illness insurance typically covers cancer, providing financial protection for treatment costs.

Does Critical Illness Pay Out For Cancer?

Yes, critical illness insurance typically pays out for cancer diagnosis, providing financial support during treatment.

Is Cancer Coverage Worth It?

Yes, cancer coverage is worth it as it provides financial protection for costly treatments. It can help ease the burden of medical expenses and provide peace of mind for you and your family.

What Is Not Covered By Critical Illness Insurance?

Critical illness insurance typically does not cover pre-existing conditions, self-inflicted injuries, or non-life-threatening illnesses. Additionally, experimental treatments and certain types of cancer may not be covered.

Conclusion

In light of the financial strain that cancer can bring, critical illness insurance can provide much-needed relief. By offering coverage for medical expenses and loss of income, this type of insurance can alleviate the burden on individuals and their families.

It’s a crucial safeguard for anyone facing the challenges of cancer, providing peace of mind during a difficult time.