Insurance For Honda Grom

Do you have to pay insurance on a Honda Grom? Grom's are slower and smaller than most motorcycles, but they're just as fun! Plus, they make a great starter bike for new riders. That said, insurance can cost anywhere from $100 to $1,000 depending on your age and state. How I Got My Honda Grom…

Progressive Insurance Debt Collection

Does Progressive send you to collections? Progressive Management Systems continues to call and attempt to collect a debt. The best thing you can do is ignore their calls and speak with a company that can help you get it removed. Progressive Auto Insurance Is Wrong For This!! Does Progressive send you to collections? Progressive Management…

Cost Of Hrt Without Insurance

How much is HRT every month? On average, the typical cost of hormone replacement therapy is somewhere in the range of $30 to $90 per month. The cost of your treatment will depend on a few factors, such as the treatment method you are using and the level of hormones you require in each dose….

Progressive Insurance Food Delivery

Can you get insurance with DoorDash? DoorDash provides auto insurance for Dashers, but this insurance applies only to accidents while using a motor vehicle on an active delivery (from order acceptance heading to the Merchant or from Merchant to the Customer). This insurance applies only after the Dasher goes through their own auto insurance policy…

Hawk 250 Insurance

Who is Hawk 250 made by? The RPS Hawk 250 is an Enduro-type motorcycle manufactured by Chongqing Haosen and Ricky Power Sports. Featuring a Honda-clone engine, 68-mph top speed, and user-friendly controls, this versatile rider can traverse technical trails with ease and is a favorite of dirt bike enthusiasts. Hawk 250 how to: license and…

Why Don T Cyclists Need Insurance

Do you need insurance for a bicycle? Do I need insurance for a bike? Bicycle insurance isn't a legal requirement. But you should strongly consider standalone bike insurance if your bike is worth more than the sum of your homeowners or renters insurance policy's coverage limits for bikes and the deductible that you would have…

Costco Contacts Insurance

Can I use insurance on Costco contacts? Does Costco Optical Take Insurance? Costco Optical does accept insurance. So, if you have vision insurance, you can use your benefits to cover the cost of your eye exam and/or glasses or contact lenses. Should You Buy Costco Contact Lenses? 3 Things You Need to Know! Can I…

Toyota Gr86 Insurance Cost

Are Toyotas expensive to insure? Insuring a Toyota costs an average of $1,226 annually. This premium is lower than average compared to other makes and models. MoneyGeek broke down auto insurance costs for major Toyota models by model year and driver age to help drivers find the best option for them. Is gt86 expensive to…

Usaa Homeowners Insurance Binder Request

What is an insurance binder USAA? An insurance binder provides temporary evidence of insurance coverage prior to the issuance of a formal insurance policy. People often need home and car insurance binders to provide proof of insurance coverage when purchasing a house with a mortgage or a new car with an auto loan. USAA Reviews…

Whole Foods Health Insurance Plan 2021

What insurance do you get through Whole Foods? Your health insurance is called the Whole Health Plan. The Whole Health Plan is administered and managed by WebTPA. Gain access to claims, deductible balances, request a replacement ID or get your questions answered by a WebTPA representative. Health Insurance Plans in California 2022 – Compare &…

What Is Exposure Management In Home Insurance

What is exposure Manager? Enterprise Exposure Manager™ is a new scalable cloud-native solution that enables (re)insurers to evaluate enterprise-wide risk, providing an improved understanding of global exposures and insights into portfolio-wide risk accumulations to enable better-informed business decisions. Understanding Property Management Exposures What is exposure Manager? Enterprise Exposure Manager™ is a new scalable cloud-native solution…

Certificate Of Insurance For Furniture Delivery

How do you get a COI for delivery? How to get a COI. Typically, your building will have a form that is already filled out with the insurance coverage limits required. Your contractor or supplier can contact your management company directly to get the form. Certificate Holders & Additional Insured How do you get a…

Homeserve Water Line Insurance Reviews

Is HomeServe Insurance legitimate? Yes, HomeServe is a legitimate company that serves more than 4 million homeowners in North America. It works with licensed and insured technicians and offers a one-year guarantee on all repairs. The company has a variety of coverage plans, including for appliances. I-Team: What You Need to Know About Your Water…

Cvs Update Insurance On App

Can I update my insurance on CVS app? How to update insurance on CVS app. To update your insurance information from the CVS app, your local pharmacy must send you a text notification. This text will contain a secure link that will open the CVS app, allowing you to scan your insurance card. How to…

Does Eye Insurance Cover Prescription Sunglasses

Can I use my glasses prescription for sunglasses? Can I use my same glasses prescription for sunglasses? The answer is yes. There are prescription sunglasses options for virtually every prescription, even for progressive lenses if you are presbyopic and need multifocal lenses. An Optometrist Explains: Prescription Sunglasses | Warby Parker Can I use my glasses…

How Much Are Stitches Without Insurance

How much does it cost to put stitches? Many urgent care centers offer stitches as a service if you need them done. Without insurance, the cost will range between $165 and $415. With insurance, you will likely pay your copay (if your insurance is accepted at the urgent care). How Much Money It Cost To…

Luxury Bag Insurance

How much does it cost to insure a handbag? Are Handbag Insurance Policies Expensive? They don't have to be. If you're insuring a handbag for its contents, you can expect to pay a minimal monthly or yearly premium. You can expect to pay as much as $3000 a year for luxury handbags, depending on how…

Dominion Energy Insurance

What is covered by homeserve? It covers the water service line, the sewer/septic line, the gas line, interior plumbing, electrical lines, your water heater and your HVAC system. Dominion Energy CEO Offers 6 Tips for Career Switchers What is covered by homeserve? It covers the water service line, the sewer/septic line, the gas line, interior…

Is Ipad Insurance Worth It

Is AppleCare worth buying for iPad? Theoretically, you could break your iPad screen four times over its first two years of life. If you did, you'd be paying a total of $196 plus the AppleCare+ fee, instead of between $1,196 and $2,596. So if you ever need any repair on any iPad, you're better off…

If I Use My Insurance Will My Parents See It

Will my parents know if I use their insurance for birth control? Thanks to doctor–patient confidentiality, your doc can't talk to your parents about these topics without your permission. The Pill is covered by most health insurance, but if you are on your parents' plan, they may know if insurance pays for it. Can I…

Root Insurance Test Drive Score

What is a good score on Root insurance? The national standard is 1.00, and anything above that shows complaints are higher than normal. Root Insurance Test Drive Review (Best Car Insurance?) What is a good score on Root insurance? The national standard is 1.00, and anything above that shows complaints are higher than normal. How…

How Much To See Ent Without Insurance

Are ents expensive? On MDsave, the cost of an ENT New Patient Office Visit ranges from $144 to $268. Those on high deductible health plans or without insurance can save when they buy their procedure upfront through MDsave. No Health Insurance and Need to See a Doctor: How to Get Treated Without Coverage 🔶 RISK…

Alaska Airlines Insurance

Is it worth it to buy flight insurance? Though you may pay 5 to 10 percent of your trip cost for travel insurance, travel insurance is often worth the investment for its potential to help reimburse you for hundreds of thousands of dollars of covered travel-related expenses like emergency evacuation, medical bills, and costs related…

Does Walgreens Take Kaiser Insurance

What insurance company does Walgreens use? Investment Life Holding Company, American National Insurance Company. Walgreens offers a program to help those without insurance called “Walgreens Prescription Savings Club.” This club is for individuals that do not have prescription drug coverage. PROS AND CONS of Kaiser Health Insurance – 2022 What insurance company does Walgreens use?…

Trader Joe’s Insurance

Does Trader Joe’s have health insurance? Medical and vision coverage are available to eligible Trader Joe's employees. The Truth About Working At Trader Joe's, According To Employees Does Trader Joe’s have health insurance? Medical and vision coverage are available to eligible Trader Joe's employees. Does Trader Joe’s offer insurance to part time employees? 12. Trader…

How Much Do Stitches Cost With Insurance

Are stitches covered under insurance? Stitches typically are covered by health insurance. For patients covered by health insurance, the out-of-pocket cost typically would include a doctor visit or emergency room copay and possibly coinsurance of 10%-50% for the procedure. How Much Money It Cost To Get Stitches With No Health Insurance In The US Are…

What Does Alaska Airlines Flight Insurance Cover

What insurance does Alaska Airlines have? Trip cancellation or trip interruption insurance up to $5,000 per ticket is available if you need to cancel or interrupt your trip due to illness, bad weather, or other unforeseen circumstances. Is Alaska Airlines Travel Insurance Worth Buying – AARDY What insurance does Alaska Airlines have? Trip cancellation or…

Google Pixel Insurance

How long is Google Pixel warranty? For the Preferred Care upfront plan, your device protection includes 1 year of mechanical breakdown coverage (after the one-year manufacturer warranty expires) and up to 2 accidental damage claims per coverage term or 2 in a rolling 12-month period or based on device. How to Insure Your Phone? How…

How To Stop Insurance Quote Calls

How do you get insurance quotes to stop calling? Register your phone number with the National Do Not Call Registry. You may register online or by calling 1-888-382-1222 (TTY: 1-866-290-4236). How To NAIL The First 30 Seconds Of An Insurance Phone Call! How do you get insurance quotes to stop calling? Register your phone number…

Sand And Ash Insurance Iceland

Do you need gravel protection in Iceland? Gravel protection is a must for people driving the Ring Road, as some parts of the route is gravel roads. Particularly in the east part of Iceland. For our 2020 Definitive Guide to Renting a Car in Iceland click here. If you intend on driving F-roads, then it's…

Aetna Insurance Card Rx Bin

What is my Rx Bin number on Aetna card? What BIN code do I use to process claims? All prescriptions submitted to Aetna for online adjudication must use BIN code 610502. Your software vendor will help you to obtain and install/set up the necessary software to submit claims online. Insurance Card Identification – Aetna (Module…

Accutane No Insurance

How much does a 30 day supply of Accutane cost? The average retail price for Accutane is $643.39 per 30, 30 Capsules Capsule, but you can pay only $192.98 with your SingleCare copay card to use the Accutane coupon. I GOT APPROVED FOR ACCUTANE!!! doctor visit, cost, and update! How much does a 30 day…

350z Insurance Cost

Is a 350Z a sports car to insurance? The Nissan 350Z is classified as a sports car and is considered a high-risk vehicle by most auto insurance companies. This, of course, means its auto insurance rates will be higher, but there are plenty of other factors that may affect the cost of auto insurance. My…

Does My Vision Insurance Cover Sunglasses

Are sunglasses covered by insurance? Most insurance companies do not cover the purchase of prescription sunglasses. The Vision Service Plan[5] , a national provider of vision insurance, does allow consumers to buy prescription sunglasses with their annual eyeglasses benefit. Typical copays, which can range from $15 to $50, will apply. Best Vision Insurance? See the…

Does Rite Aid Take Kaiser Insurance

Can I use Kaiser at Walgreens? You can also fill your prescriptions at any of the over 60,000 MedImpact pharmacies throughout the country. MedImpact pharmacies include Walgreens, CVS, Rite Aid, Kroger, Safeway, and Costco, plus hundreds of independent pharmacies nationwide. PROS AND CONS of Kaiser Health Insurance – 2022 Can I use Kaiser at Walgreens?…

Botox For Teeth Grinding Insurance

Can Botox ever be covered by insurance? 99% of commercial insurance plans cover the majority of BOTOX® costs. The BOTOX® Savings Program helps eligible patients receive money back on any out-of-pocket out-of-pocket An out-of-pocket expense (or out-of-pocket cost, OOP) is the direct payment of money that may or may not be later reimbursed from a…

Cvs Add Insurance

Can I add my insurance card to CVS app? How to update insurance on CVS app. To update your insurance information from the CVS app, your local pharmacy must send you a text notification. This text will contain a secure link that will open the CVS app, allowing you to scan your insurance card. Rx…

Riding Motorcycle Without Insurance

Do you need insurance to ride a motorcycle UK? By law, motorcycle insurance is required for anyone riding a motorbike on the road in the UK. At a minimum, motorbike insurance protects you against liability if your motorcycle is in a crash and cause injury to someone else or damage to another vehicle. Riding Without…

Upack Insurance

Why is U-Pack cheaper than PODS? U-Pack is more affordable than PODS thanks to its pay-for-what you-use-policy and transparent prices. PODS isn't unreasonably expensive though—its rates are only slightly above average compared to competitors. PODS does bake 30 days of storage time into your rental price (U-Pack's rates include just three days). U-Pack: 4 Things…

Is Regence Health Insurance Good

Is Regence the same as Blue Shield? Regence is the name given to Blue Cross and Blue Shield plans in four northwestern states. Serving 2.2 million members, Regence offers health insurance plans under the following names. HEALTH INSURANCE 101: Why Regence Is Regence the same as Blue Shield? Regence is the name given to Blue…

Does Lighting Mcqueen Have Life Insurance Or Car Insurance

Will Lightning McQueen get life insurance or car insurance? Since his physical being is visualized as a car, he would life insurance. However, the semi-truck that he rides in would have car insurance. Would Lightning McQueen have Life Insurance or Car Insurance? Will Lightning McQueen get life insurance or car insurance? Since his physical being…

Fmlwz Insurance

Is FamilyWize legit? FamilyWize is a drug savings mobile app and website that can save you up to 45% on most FDA-approved brand and generic prescription medications. While it is a for-profit business, it's endorsed by many of the biggest names in the nonprofit world. PLPD vs Full Coverage Insurance: What's The Difference | Michigan…

Ring Insurance Certificate

Is ring doorbell considered a security system for insurance? Can it get me a Homeowner's Insurance Discount? While the Ring Video Doorbell is an amazingly useful tool when it comes to home security, unfortunately, it doesn't qualify as a security system – not on its own anyway. The Truth About Engagement Ring Insurance! Everything You…

Water Damage Kitchen Cabinets Insurance

Can cabinets be repaired from water damage? Depending on the extent of the water damage, you might be able to repair kitchen cabinets. If the water has delaminated parts of the cabinet, use carpenter's glue and clamps to repair the damage. Spread the carpenter's glue between the delaminated layers of the cabinets, then use the…

Is Personal Training Covered By Health Insurance

Should I pay for personal training? Hiring a personal fitness trainer might seem like a luxury if you are on a tight budget, but if you really want to get the most out of your workouts, a trainer is a great investment. The improvement in your health and fitness levels can have long-term payment in…

Bybit Mutual Insurance

What is Bybit mutual insurance? Bybit insurance fund covers the excessive losses (negative equity) caused by positions closed at worse than bankruptcy prices. It mitigates the risk of auto-deleveraging. The insurance fund is collected from the residual margin of liquidated positions that are closed at better than bankruptcy prices. BYBIT – INTRO TO MUTUAL INSURANCE…

Can You Sell Breast Pump From Insurance

Can you resell a breast pump? If you are done with your pump forever, selling your used breast pump – or donating it – may be an option. However, used pumps should only be reused by another individual when they are a closed system pump. If you have an open system pump, you should not…

Carvana Gap Insurance

Is gap insurance worth getting? Gap coverage is worth it only as long as you are leasing a car or if you owe more on a loan than your car is worth. You don't need gap insurance if you don't have a car loan or lease. You won't need gap insurance forever. Drop gap insurance…

2a Form Massachusetts Insurance

What is a 2A form in insurance? The industry developed a notice of transfer form, commonly known as a Form 2A, that. producers historically have used to notify the previous producer of record or prior insurer when. an insured transfers the insurance covering a registered vehicle. Everything YOU Need To Know: Massachusetts Auto Insurance What…

Does Getting Your Car Impounded Affect Your Insurance

How much are impound fees in California? The standard impound fee was previously $135.00. However, on January 1st, 2021, the impound fee increased to $136.50. If the police impounded an upright heavy-duty vehicle, it would cost you $262.00. Sometimes specialized equipment is required to move these larger vehicles. Does Getting Your Car Impounded Affect Your…

Insurance Incredibles

Who plays the insurance guy in The Incredibles? Gilbert Huph (voiced by Wallace Shawn) is Bob Parr's diminutive, strict supervisor at his insurance company Insuricare. What does the Insuricare letter say? The letter concludes by saying that Insuricare has "recorded its highest profits in years." Clothing, with its textures, weaving and stitching, is notoriously difficult…

Do You Need Insurance For Carvana

Can Carvana reject your car? They can reject the vehicle entirely at no charge, opt to have Carvana fix the issues before delivery, or accept the car as-is and then use Carvana's after-sale repair option at no extra cost. If for any reason the customer is unhappy with their purchase, we offer a 7-day money…

Insurance Is A Racket

Is insurance a monopoly? When Americans buy health insurance they typically find they have fewer and fewer choices. In some states, such as Alabama, a single insurance company has a near total monopoly. In half of all metro areas, just two health insurers divide two-thirds of the market. Insurance Is A huge Racket And You…

Aya Health Insurance

Does Aya offer health insurance? A comprehensive medical, dental and vision plan from the first day you start an assignment with Aya Healthcare. You also have the option to add a spouse and/or dependents to your plan! What Happens After I Click Apply? | Aya Healthcare Does Aya offer health insurance? A comprehensive medical, dental…

National Processing Center Mortgage Insurance

What is central processing center? Central Processing Centre (CPC) means a Branch of Head Post Office, where all work relating to PLI/ RPLI is carried. Who is the distribution processing center? Distribution Processing Center, LLC (DPC) is a third-party mail processor. We work with legitimate insurance entities distributing their mail responses and maintaining their do…

Fake Insurance Card For Uber

Do I need to tell my insurance I drive for Uber eats? Yes, you must tell your insurance provider that you drive for Uber Eats. Why does Uber keep rejecting my documents? This can happen sometimes and it could be for a number of reasons: Please check all the details on your documents are correct…

Bassoon Insurance

Should I insure musical instruments? Insuring a musical instrument is a good idea if it would be cost-prohibitive to replace it, or if the instrument is needed regularly for performances or teaching. Insurance often covers more than just the actual instrument; it might also cover the case, accessories and even sheet music. How much does…

Does Costco Take Vsp Vision Insurance

How much does VSP cover at Costco? How Much Does VSP Cover At Costco? VSP's Standard Option plan comes with a $150 frame allowance for any frame brand and a $200 allowance for featured frame brands. Depending on the services or products you purchase, VSP insurance will provide you with anywhere from a $50 to…

Progressive Insurance Assessment Test

What assessment test does Progressive Insurance use? These psychometric tests are used to determine how well you fit in with the company, your responses in certain situations, and your customer service style. You will be given a time frame during which you must take the screening to be able to continue in the hiring process….

Genesis Coupe Insurance

Are Genesis Coupes expensive to insure? The average annual cost to insure a Hyundai Genesis Coupe 3.8L is $2,977, which is $149 higher than the average annual cost to insure Hyundais. The base cost of your vehicle will make an impact on your insurance rates—in general, a more expensive car will have higher coverage costs….

Can I Use Kaiser Insurance At Walgreens

Does Walgreens take Medi Cal? This means that Medi-Cal members will have access to a broader network of pharmacies with no change to their eligibility benefits. The fee-for-service network includes pharmacies like Walgreens, CVS, Safeway, and many more. What states is Kaiser Permanente in? Kaiser Permanente service areas include all or parts of: • California…

Is Water Line Insurance Worth It

How long do water lines last? Here are the expected lifespans for common supply pipes: Copper Pipes: 70-80 years. Brass Pipes: 80-100 years. Galvanized Steel Pipes: 80-100 years. Water Line/ Sewer Insurance, do you need it? How long do water lines last? Here are the expected lifespans for common supply pipes: Copper Pipes: 70-80 years….

Botox Bruxism Covered Insurance

Can BOTOX ever be covered by insurance? 99% of commercial insurance plans cover the majority of BOTOX® costs. The BOTOX® Savings Program helps eligible patients receive money back on any out-of-pocket out-of-pocket An out-of-pocket expense (or out-of-pocket cost, OOP) is the direct payment of money that may or may not be later reimbursed from a…

Target Health Insurance Cost

How much does health insurance cost for Target employees? Monthly premiums will drop to as little as $20 for individuals with Target covering the rest of the insurance plan premiums. But deductibles will be much higher than Target's traditional plan: up to $5,000 for families, including Target's contribution. Target Employee Benefits | Benefit Overview Summary…

Cancel Tesla Insurance

Can I cancel Tesla insurance at any time? Tesla Insurance offers a convenient monthly payment with no hidden fees or charges. Customers may cancel or change their Tesla Insurance policy at any time. How Tesla Insurance Will Crush the Industry Can I cancel Tesla insurance at any time? Tesla Insurance offers a convenient monthly payment…

Audi S4 Insurance

Is Audi S4 expensive to insurance? Audi S4 car insurance rates average $1,924 a year for full coverage, or $160 if paid each month. Expect to pay around $79 less each year for Audi S4 insurance compared to the midsize luxury cars average rate, and $373 more per year than the all-vehicle national average of…

Gap Insurance For Tesla Model 3

Does Tesla have gap insurance? If you take your Tesla on a lease with no option to own the vehicle written in, then this can be covered by a Lease & Contract Hire Gap Insurance policy. This is designed to cover you, in the event of a total loss, between: the motor insurers settlement at…

What is Homeowners Insurance and What Are the Standard Deductibles?

Image Source: Flickr Homeowners insurance protects you, your family, and your home from financial loss caused by a covered loss. It covers your house and its contents against certain risks. A risk is anything that can cause financial loss. Examples of risks include natural disasters, fire, theft, and vandalism. Your homeowners insurance protects you…

Defamation in Insurance: What It Is and How to Avoid Lawsuits

Image Source: Flickr Imagine you’re shopping for a car. In the dealership, salespeople try to convince you to buy a particular model. They will point out its great features, its high resale value, and other benefits of owning that car. If you’re like most people, you’ll probably think to yourself that the salespeople are…

How To Use Life Insurance Payout To Your Advantage

Life insurance can be a valuable tool for planning for your future and protecting your family. When you take out a policy, you have a specific purpose in mind. Maybe you just want to help ensure that your loved ones are taken care of after you pass away. Maybe you want to plan for something…

What is Bodily Injury Insurance? – A Quick Explanation

When someone sustains an injury at work, it can be devastating. Medical bills, lost wages, and pain and emotional turmoil can all feel insurmountable. That’s why it’s so important to have the right coverage. Fortunately, there are a variety of affordable options, such as bodily injury insurance, to help alleviate the financial stress. A bodily…

What is Coin Insurance? – The Most Common Types and More!

Image Source: Freepik Insurance is something most people take for granted. It’s the type of thing you never think about until you need it. And even then, most people just hope they’ll never need it. But what if you need insurance to protect your investments? Even if you’re not a gimbling’ man, you know that…

What Does Rxgrp Mean on Your Insurance Card? STOP Wondering!

You’ve just received your insurance card from your insurance company, and you’re wondering what the letter “Rxgrp” means at the end of your insurance card. The letter Rxgrp is a part of the standard practice in insurance cards issued by insurance companies. Insurance companies follow a set of standard practices to ensure correct identification of…

The Warby Parker Insurance Plan: What You Need to Know

If you’re like most people, you probably spend a lot of time looking for affordable car insurance. After all, your monthly premium isn’t the only thing that matters when you’re shopping for car insurance. The coverage you get from an insurance company also plays a role. And that’s why many policy holders are moving towards…

How to Get Aggregate Insurance in Canada and the United States

Image Source: Flickr In the United States and Canada, the majority of people who drive cars are covered by personal auto insurance. This insurance protects you and your car in the event of an accident, and it costs you an average of $1,050 a year in premiums. Furthermore, some of that figure is tax deductible,…

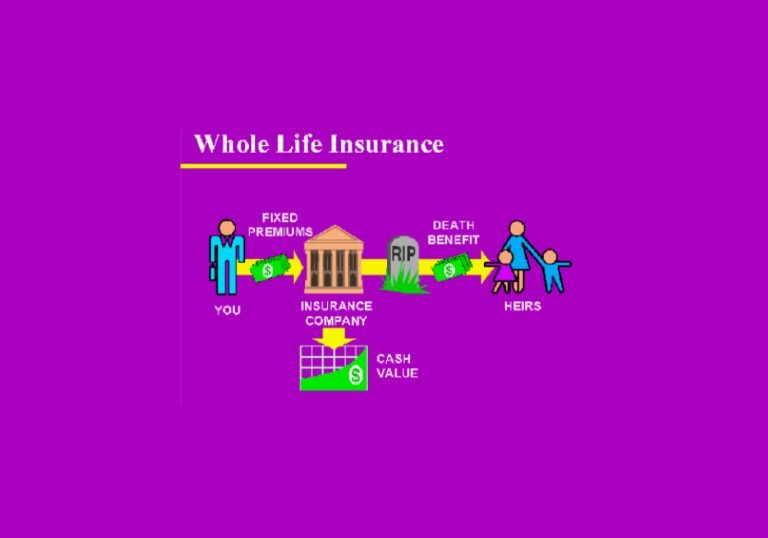

Understanding the Difference Between Whole Life and Term Life Insurance – The Ultimate Guide

When it comes to life insurance, the options can feel overwhelming. In addition to the many different types of insurance available, the prospect of deciding on a level of coverage can be daunting as well. Today, we’ll help you understand the difference between whole life and term life insurance, and which one makes the most…

The 6 Most Common Terms on Captive Insurance (And How They Are Helpful)

Captive insurance is insurance that is held by a third party for the insured person. In some cases, it is sold to businesses or individuals who want to protect themselves against potential risks. In other cases, it is provided by companies that specialize in insuring specific risks. Either way, having captive insurance means having a…

What is FDIC Insurance? – Find Out What It Is, How It Works, and the Benefits

FDIC insurance is a type of deposit insurance that helps protect FDIC-insured banks from failing. In order to protect these banks, the government requires all FDIC-insured banks to maintain certain levels of capital. That capital comes in the form of FDIC insurance. Many people are unfamiliar with this type of insurance, so let’s take a…

How does an insurance binder work? What They Are and Why You Need One?

The world can be a scary place when you don’t have health insurance. It’s hard to know if you need it or not, and if you’re spending too much for it. That’s why everyone needs to know about insurance binders. How does an insurance binder work? Well, let’s take a look. What is an Insurance…

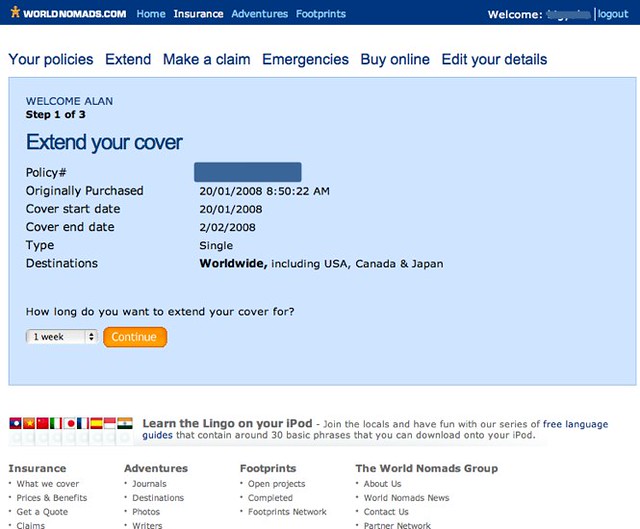

Everything You Need to Know About Travel Insurance: 8 Essential Tips

In case you haven’t heard, travel is becoming increasingly popular and affordable for everyone. Today, more than 230 million people are traveling overseas every year, and the popularity of international travel has only grown in the past few years. However, as with any other activity, travel can have risks, too. Travel insurance provides travelers with…

What is HSA Insurance? – A Guide to the Health Savings Account

The Health Savings Account (HSA) is a tax-advantaged savings account that allows you to save money out of your paycheck for medical expenses later. The best part? You don’t even have to pay taxes on the interest! If you’re new to the world of health savings accounts, you might be wondering what exactly they are….

What You Need to Know About Epo Insurance: A Guide Through the Ins and Outs

Epilepsy is a chronic neurological disorder characterized by recurring seizures. An estimated 36 million people worldwide have epilepsy, and 3.4% of the U.S. population has the condition. In most cases, the seizures of epilepsy are mild and can be treated with anti consultant drugs. However, for some, the frequency and severity of seizures can grow…

Pet Insurance FAQ: What Does It Cover and How Much Does It Cost?

Image Source: Flickr Pet insurance is supposed to cover the financial costs of veterinary care in the event your pet becomes sick or injured. But with so many different types of pet insurance and so many questions about them, it’s no wonder so many pet owners feel confused. Read on to learn more about…

Is Your Insurance Card Lost, Stolen or Withdrawn? Find Out Here!

Do you love your insurance card and everything it offers? Then you’ll love this! Your insurance card may be lost, stolen, or simply withdrawn. No worries, though. This is where the “find your card” feature comes in handy. As the name suggests, you can use this option to find out details regarding your insurance card….

What is Liability Insurance Coverage? Get the Facts on Liability Insurance for Your Business

Liability insurance is a type of insurance that protects businesses from financial losses due to accidents, bodily injury or property damage they cause. It also covers businesses for any legal liabilities they may incur. Why do businesses need liability insurance? Liability insurance covers a business for financial losses that result from accidents, bodily injury or…

Cobra Insurance: What Is It? How Does It Work?

If you’ve ever watched the TV show Fear Factor, you know that the survivalist show is not for the faint of heart. If you’ve ever watched the show, you know that it gives people challenges that are not for the faint of heart. You see, the show challenges contestants to survive a variety of different…

What is Umbrella Insurance? How It Works and What it Covers

When the weather throws a curve ball, you can’t always plan for the unexpected. That’s why it’s smart to have an umbrella insurance plan in place. Umbrella policies are a way to protect you and your loved ones from unexpected financial losses. You can get coverage for a wide range of financial risks. And, with…

Why is State Farm Homeowners Insurance So Expensive?

Do you know how much your home is worth? According to the Federal Reserve, the median American family’s net worth is $96,500. If you’re a homeowner, does that number include your house? It should. Your home is probably one of your most valuable assets. So why can’t homeowners insurance be just as valuable? Why is…

How Much Is Motorcycle Insurance For A 16 Year Old?

Hi: I am 16 and would like to get a motorcycle. I don’t know how much will insurance cost me, and it’s impossible to find this information over the Internet (too many factors). I found out that even if I get a scooter/moped (maximum 50cc), it still counts as a “bike” in terms of the…

How Much Is Insurance On A Ferrari 12 Hidden Facts?

The cost of insuring the cost of a Ferrari is $5,325 over six months of coverage. This makes it five times higher than the price of insurance across America. Owning a sports car has always been a dream for many people. And it comes as no surprise that such cars are often seen zooming…

How To Get Rhinoplasty Covered By Insurance?

Rhinoplasty is a surgical procedure that can improve the appearance of your nose. It’s a common cosmetic surgery procedure, and many people choose to have it done for aesthetic reasons. If you’re considering rhinoplasty, you may be wondering how to get the surgery covered by insurance. Unfortunately, most insurance plans don’t cover rhinoplasty procedures. However,…

How To Get Gynecomastia Surgery Covered By Insurance?

So you want to get gynecomastia surgery covered by insurance? Here’s a step-by-step guide on how to make it happen. Make sure you have a legitimate medical need for the surgery. Insurance companies are more likely to cover the procedure if they believe it is medically necessary. Talk to your doctor about your condition and…

How Much Is A Chiropractor Without Insurance?

Chiropractors are often seen as a necessary part of health care. However, many people do not understand how much a chiropractor without insurance costs. The cost of a chiropractor without insurance can vary depending on the location and the chiropractor’s rates. In general, most chiropractors charge between $50 and $100 for a visit to their…

How Much Does Invisalign Cost Without Insurance For 5 Prime Locations?

It’s important to realize that price differences are mostly due to geographic location. For example, in March 2013 the average cost per case for Invisalign is $1,219 USD in the United States and it’s only $1,109 USD in Canada. Introduction: Before discussing the cost of Invisalign, it’s important to understand what the process includes. …