Looking for affordable life insurance for seniors over 60? There are options available that cater specifically to the needs of this age group, providing coverage at reasonable rates.

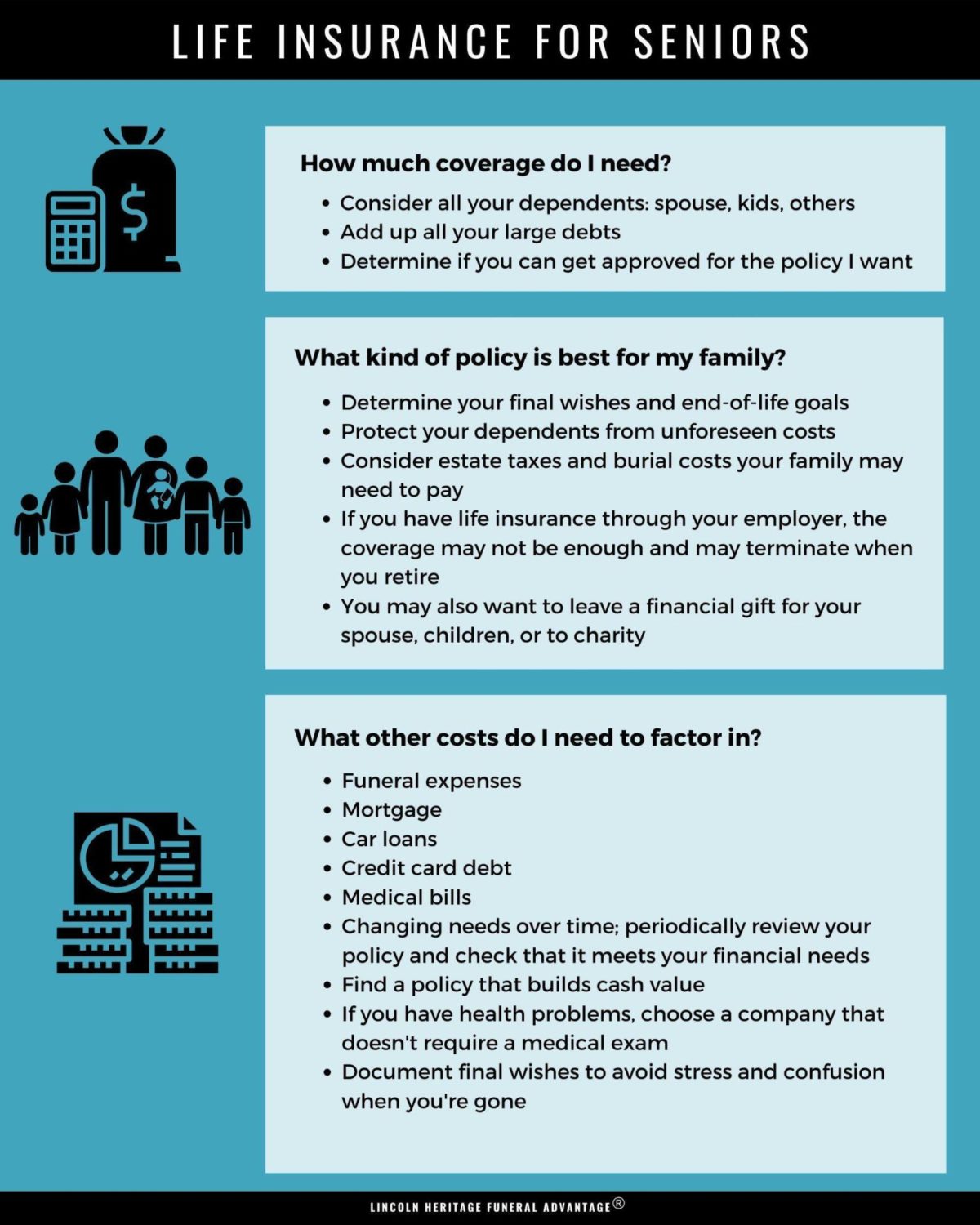

As people age, it becomes increasingly important to secure a life insurance policy to protect their loved ones financially. With the right plan, seniors can ensure that their final expenses are covered and leave a legacy for their family. Additionally, some policies offer guaranteed acceptance without the need for a medical exam, making it easier for seniors to obtain coverage.

By exploring the various options and comparing quotes, seniors can find a life insurance plan that meets their needs and budget, offering peace of mind for themselves and their families.

Table of Contents

Why Seniors Over 60 Need Life Insurance

Life insurance for seniors over 60 provides financial security for loved ones by covering final expenses and funeral costs. It ensures that seniors can leave behind a legacy rather than a financial burden. With affordable life insurance options, seniors can secure their family’s future and ease the financial burden during a difficult time. Seniors can also use life insurance as a source of income for their retirement years, providing added peace of mind. It’s crucial for seniors to explore their life insurance options and find a plan that meets their needs without breaking the bank.

Credit: www.linkedin.com

Types Of Life Insurance Available For Seniors Over 60

When seniors over 60 are looking for affordable life insurance, there are several types of policies available to meet their needs.

Term Life Insurance: This type of policy provides coverage for a specific period, typically 10, 20, or 30 years, at a fixed rate.

Guaranteed Universal Life Insurance: This policy offers lifetime coverage with fixed premiums, making it a popular choice for seniors.

Simplified Issue Whole Life Insurance: Seniors can obtain this policy without a medical exam, and it provides lifelong coverage with fixed premiums.

Factors To Consider When Choosing A Life Insurance Policy

When considering a life insurance policy for seniors over 60, it’s crucial to weigh several factors.

Premium Costs: Compare and analyze premium rates from various insurance providers to find the most affordable option.

Coverage Amount: Assess your financial needs and select a policy that offers adequate coverage for your family.

Medical Underwriting: Understand the medical evaluation process and its impact on policy premiums.

Policy Features: Look for policies with flexible features that cater to the specific needs of seniors.

Credit: www.lhlic.com

Top Life Insurance Providers For Seniors Over 60

When seniors over 60 are searching for affordable life insurance, several top providers stand out. AIG, Mutual of Omaha, Transamerica, and New York Life offer competitive rates and coverage options tailored to the needs of seniors. These providers understand the unique requirements of older individuals and provide policies that cater to their specific circumstances. By choosing a reputable life insurance company, seniors can ensure financial security and peace of mind for themselves and their loved ones. With the right coverage, seniors can enjoy their golden years without worrying about the financial burden they may leave behind. These top providers have a proven track record of reliability and commitment to serving the needs of seniors over 60.

How To Apply For Affordable Life Insurance As A Senior Over 60

As a senior over 60, finding affordable life insurance can be a daunting task, but it’s not impossible. The first step in applying for life insurance is gathering the necessary information. This includes your medical history, any pre-existing conditions, and any medication you take. Once you have this information, you can start comparing quotes and policies from different insurance companies. Be sure to look for policies with low premiums and high coverage amounts.

After comparing policies, you can start the application process. This typically involves filling out an application and providing any additional information that the insurance company may require. You may also need to undergo a medical exam or provide a blood sample. Once you’ve completed the application process, you’ll need to wait for the insurance company to review your application and determine if you’re eligible for coverage.

| Gathering Necessary Information | Comparing Quotes and Policies | Completing the Application Process |

|---|---|---|

| Medical history | Low premiums and high coverage amounts | Fill out an application |

| Pre-existing conditions | Review policies from different insurance companies | Provide any additional information required |

| Current medication | Consider the reputation of the insurance company | Undergo a medical exam or provide a blood sample |

Credit: www.pinnaclequote.com

Tips For Getting The Best Rates On Life Insurance

For seniors over 60, maintaining good health is crucial for affordable life insurance rates. Choose the right policy based on your needs and budget. Shop around for quotes from different providers to get the best rate.

Faqs About Life Insurance For Seniors Over 60

Learn about affordable life insurance options tailored for seniors over 60 with these frequently asked questions. Find valuable insights on coverage, premiums, and benefits to secure your financial future. Get expert guidance on selecting the right policy for your needs.

| Maximum Age: Life insurance coverage for seniors over 60 typically has a maximum age limit. |

| Medical Exam: Some policies may require a medical exam, but there are options available without one. |

| Policy Changes: It’s possible to adjust your policy to meet changing needs as you age. |

Frequently Asked Questions

What Is The Best Life Insurance For A 60 Year Old?

The best life insurance for a 60-year-old is term life insurance. It offers affordable coverage for a specific period, providing financial security for your family. Consider a policy with a term that aligns with your financial obligations, such as mortgage payments or supporting dependents.

What Is The Cheapest Life Insurance For Seniors?

The cheapest life insurance for seniors varies based on individual circumstances. It’s best to compare quotes from different providers. Factors like age, health, and coverage amount can impact the cost. Consider term life or guaranteed issue whole life policies for affordable options.

What Do You Get For $9.95 A Month From Colonial Penn?

For $9. 95 a month from Colonial Penn, you get guaranteed acceptance life insurance with fixed premiums.

How Much Is Aarp Life Insurance A Month?

AARP life insurance costs vary by age, coverage amount, and health. On average, rates start at $15 per month.

Conclusion

Securing affordable life insurance for seniors over 60 is crucial for financial peace of mind. By comparing quotes and exploring different options, seniors can find coverage that fits their needs and budget. Don’t wait to protect your loved ones’ future – start the process today and gain peace of mind.