Long-term care insurance for couples provides coverage for both individuals in the event of needing long-term care services. It offers financial protection and peace of mind for couples, ensuring they can afford quality care without depleting their savings.

Long-term care insurance policies for couples typically offer shared benefits, meaning both partners can access each other’s benefits if needed. This type of insurance also helps preserve the couple’s assets and allows them to maintain their standard of living. By planning ahead and investing in long-term care insurance, couples can better prepare for the future and alleviate the financial burden of potential long-term care needs.

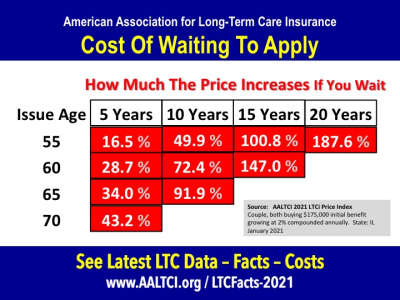

Credit: www.aaltci.org

Table of Contents

Why Long-term Care Insurance Is Important For Couples

Long-term care insurance is essential for couples as they age. Statistics show that a significant percentage of individuals will require long-term care at some point in their lives. The cost of long-term care can be substantial and can place a significant financial strain on couples. Long-term care insurance provides financial protection by covering the expenses associated with long-term care services. It allows couples to access the care they need without depleting their savings or retirement funds. By securing long-term care insurance, couples can safeguard their financial well-being and ensure that they have access to quality care when the need arises.

Credit: www.cbsnews.com

Factors To Consider When Choosing Long-term Care Insurance For Couples

When considering long-term care insurance for couples, it is important to assess the age and health status of each spouse. This will determine the type of coverage needed, whether shared or individual policies. Age and health are crucial factors in determining the cost and availability of coverage.

How To Determine The Right Amount Of Coverage For Couples

Long-Term Care Insurance for Couples

Determining the Right Amount of Coverage for Couples

When considering long-term care insurance for couples, it’s important to calculate the cost of care in your area. This involves researching the expenses associated with various types of long-term care services and facilities. Next, determine your budget for premiums by evaluating your financial situation and discussing your insurance options. It’s crucial to balance coverage and affordability to ensure that you’re adequately protected without straining your finances. By carefully assessing your needs and resources, you can make informed decisions about the amount of coverage that’s right for you and your partner.

:max_bytes(150000):strip_icc()/dotdash-031005-Medicaid-vs-Long-Term-Care-Insurance-Final-96bd18c9639a483696cb6e2049e37650.jpg)

Credit: www.investopedia.com

Tips For Getting The Best Long-term Care Insurance Rates For Couples

When looking for the best long-term care insurance rates for couples, it’s important to compare quotes from different providers. Taking advantage of discounts and bundling options can help you save money on premiums. Working with an independent insurance agent can provide personalized guidance and access to a wider range of coverage options.

What To Look For In A Long-term Care Insurance Policy For Couples

When considering long-term care insurance policies for couples, there are several important factors to keep in mind:

- Inflation Protection: Make sure the policy includes inflation protection to ensure that benefits keep up with rising costs of care.

- Coverage for Home Care and Assisted Living Facilities: Look for a policy that covers both home care and assisted living facilities to provide flexibility in care options.

- Benefit Triggers and Waiting Periods: Understand the benefit triggers and waiting periods for the policy to determine when benefits will be paid and how long the waiting period is.

By carefully considering these factors and comparing policies, couples can find a long-term care insurance policy that meets their unique needs and provides peace of mind for the future.

Common Mistakes To Avoid When Buying Long-term Care Insurance For Couples

When purchasing long-term care insurance for couples, it’s important to avoid common mistakes. Consider factors like coverage limits, shared benefits, and inflation protection to ensure comprehensive and cost-effective coverage for both partners. Researching multiple providers and policy options can help couples find the best fit for their long-term care needs.

| Waiting Too Long to Buy Coverage | Not Considering Future Health Needs | Choosing Inadequate Coverage |

| Starting early ensures adequate coverage and lower premiums. | Anticipate potential health changes to avoid gaps in coverage. | Ensure the policy covers essential long-term care services. |

| Don’t wait until health issues arise to purchase insurance. | Think about the level of care needed in the future. | Review policy details to ensure it meets your requirements. |

How To Make Long-term Care Insurance Work For Couples

Planning for long-term care as a couple is crucial for financial security.

Creating a joint plan tailored to both partners’ needs is essential.

Regularly reviewing and updating coverage ensures adequacy for changing circumstances.

Effective communication with family members and caregivers is vital for coordination.

Having a clear understanding of each partner’s role in the care plan is important.

Frequently Asked Questions

What Is The Biggest Drawback Of Long-term Care Insurance?

The biggest drawback of long-term care insurance is the cost, which can be expensive. Premiums may increase over time and may not cover all care expenses.

What Are The Three Main Types Of Long-term Care Insurance Policies?

The three main types of long-term care insurance policies are traditional, hybrid, and combination policies. Traditional policies offer standalone long-term care coverage. Hybrid policies combine long-term care with life insurance or annuities. Combination policies allow policyholders to use funds for long-term care or leave them as a death benefit.

What Is The Rule Of Thumb For Long-term Care Insurance?

The rule of thumb for long-term care insurance is to purchase a policy in your 50s or early 60s for lower premiums and better coverage.

Who Most Needs Long-term Care Insurance Protection?

Long-term care insurance is crucial for seniors and individuals with chronic health conditions. It offers financial protection for long-term care services.

Conclusion

Planning for long-term care insurance as a couple ensures financial security and peace of mind. By exploring various coverage options and tailoring a plan to your specific needs, you can safeguard your future together. Make informed decisions to protect your health and assets for a worry-free retirement.