Low-cost dental insurance for families is essential for affordable oral care. It helps families save money on routine check-ups, cleanings, and other dental services.

Dental insurance plans typically cover preventive care, such as regular exams and cleanings, as well as basic and major dental procedures, including fillings, crowns, and root canals. Families can enjoy peace of mind knowing that their dental insurance will help offset the costs of their oral health needs.

By choosing a low-cost dental insurance plan, families can prioritize their dental health without breaking the bank. With the right coverage, families can access quality dental care and maintain healthy smiles for everyone.

Table of Contents

The Importance Of Dental Insurance

The importance of dental insurance cannot be overstated. Preventive care benefits are a key aspect of dental insurance, as they encourage regular check-ups and cleanings, helping to maintain good oral health. In the long run, having dental insurance can lead to significant cost savings by covering a portion of the expenses for treatments and procedures, reducing the financial burden on families.

Credit: dentalplansdirect.com

Types Of Low-cost Dental Insurance Plans

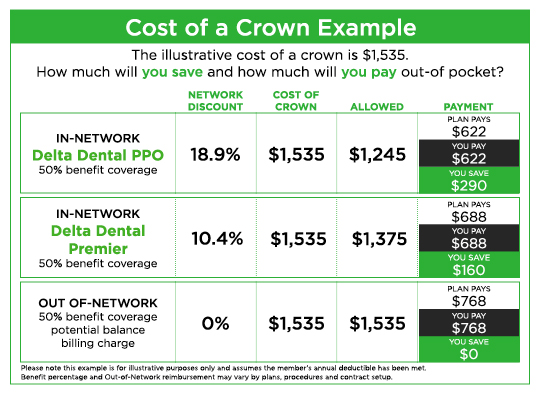

Preferred Provider Organizations (PPOs): These plans offer a network of dentists who provide services at a reduced cost. Members have the flexibility to visit out-of-network dentists, but at a higher cost.

Health Maintenance Organizations (HMOs): HMO plans require members to choose a primary dentist and all dental services must be obtained through this dentist. This often results in lower out-of-pocket costs.

Discount Dental Plans: These plans offer discounted rates on dental services from participating dentists. Members pay an annual fee to access these reduced rates.

Factors To Consider When Choosing A Plan

When choosing a low-cost dental insurance plan for your family, consider the coverage for basic services. Ensure that the plan includes essential treatments such as cleanings, fillings, and X-rays. Additionally, look for a network of dentists that are conveniently located near your home or workplace. This will make it easier for you to schedule appointments and receive timely care. Moreover, check the annual maximum benefits to make sure that the plan provides adequate coverage for your family’s dental needs. By considering these factors, you can select a dental insurance plan that offers quality coverage at an affordable price.

How To Find Affordable Dental Insurance

Finding affordable dental insurance for your family can be a daunting task. One option is to explore employer-sponsored plans, which often provide cost-effective coverage. State-sponsored programs also offer assistance for low-income families. Online comparison tools can help you easily compare different insurance options to find the best fit for your budget and needs. By exploring these avenues, you can find a low-cost dental insurance plan that provides the coverage your family needs without breaking the bank.

Tips For Maximizing Your Dental Insurance Benefits

Common Misconceptions About Low-cost Dental Insurance

Many people assume that low-cost dental insurance offers limited coverage, which may result in poor quality of care. However, this is not always the case. While some plans may have limited coverage, others offer comprehensive benefits at an affordable price. It’s important to carefully review the details of any plan you are considering to ensure it meets your needs.

Additionally, some people believe that low-cost insurance means they will receive subpar care from dentists. However, many dentists accept low-cost insurance plans and provide high-quality care to their patients. It’s important to do your research and find a dentist who is reputable and experienced in treating patients with your insurance plan.

| Common Misconceptions | The Truth |

|---|---|

| Low-cost dental insurance has limited coverage | Some plans offer comprehensive benefits at an affordable price |

| Low-cost insurance means poor quality of care | Many dentists accept low-cost insurance plans and provide high-quality care |

By understanding these common misconceptions about low-cost dental insurance, you can make informed decisions about your dental care. Remember to review the details of any plan you are considering and find a reputable dentist who accepts your insurance.

Case Studies: Families Saving With Low-cost Dental Insurance

Discover how families are saving money with low-cost dental insurance through real-life case studies. With affordable coverage options, these plans provide access to quality dental care for the entire family, ensuring peace of mind and financial security. Say goodbye to expensive dental bills and hello to affordable dental insurance for your family’s oral health needs.

| Case Studies: Families Saving with Low-Cost Dental Insurance |

| Family A: Preventive Care Success Story |

| Family B: Emergency Savings |

Credit: www.deltadentalwa.com

Final Thoughts On Affordable Dental Insurance

Discovering low-cost dental insurance for families is a crucial investment in oral health. With various affordable options available, finding the right plan can provide peace of mind and financial security. By comparing different providers and coverage options, families can secure a suitable dental insurance plan to meet their needs.

| Low-Cost Dental Insurance for Families |

| Final Thoughts on Affordable Dental Insurance |

| Investing in Your Family’s Health |

| Peace of Mind for Unexpected Dental Expenses |

:max_bytes(150000):strip_icc()/4-important-steps-choosing-dental-insurance_final-ca92ac11c9564b15995b97795932b339.png)

Credit: www.investopedia.com

Frequently Asked Questions

How Much Is Dental Insurance In Tx?

Dental insurance costs vary in Texas, typically ranging from $20 to $50 per month. Factors like coverage level and provider influence pricing.

Is The Dental Grant Of Texas Real?

Yes, the dental grant of Texas is real and offers financial assistance for dental care.

What Is The Best Dental Insurance To Have?

The best dental insurance varies based on individual needs and budget. It’s important to research and compare plans to find one that covers necessary treatments and procedures while fitting within your budget. Look for plans with low deductibles and co-pays, and check if they cover preventative care and major dental work.

Is Aflac Dental Worth It?

Yes, Aflac dental insurance can be worth it for those seeking coverage for dental expenses. It provides financial protection for various dental treatments and can help save money on dental care costs.

Conclusion

Securing low-cost dental insurance for families is crucial for maintaining oral health. With the right plan, families can access quality care without breaking the bank. Prioritize your family’s dental well-being by exploring affordable insurance options tailored to your needs. Protect smiles and budgets simultaneously with the right coverage.