If you are looking for health insurance, you may have come across the term PPO. But what is PPO insurance? Simply put, it is a type of health coverage that gives you more flexibility than traditional HMOs. Let’s take a closer look at the pros and cons of PPO insurance to see if it is the right choice for you.

One of the biggest advantages of PPO insurance is that you have more freedom to see the doctors and specialists you want. With an HMO, you are generally required to stay within a specific network of providers. But with a PPO, you can still use in-network providers for the best rates. However, you also have the option to see out-of-network providers, though you will likely have to pay more for these services.

Another advantage of PPOs is that you don’t need a referral from your primary care physician to see a specialist. With an HMO, you generally need to get a referral from your PCP before you can see a specialist. But with a PPO, you can simply make an appointment with the specialist you need.

However, there are also some drawbacks to PPO insurance. One of the biggest is that it can be more expensive than HMO coverage. This is because you have more freedom to see out-of-network providers and specialists. In addition, PPOs generally have higher deductibles than HMOs.

So, is PPO insurance right for you? It really depends on your individual needs and preferences. If you value flexibility and freedom when it comes to your healthcare, then a PPO may be the right choice for you. However, if you are looking for the most affordable option, an HMO may be a better fit.

Do you have PPO insurance? What are your thoughts on it?

Pros:

- You have more freedom to see the doctors and specialists you want.

- You don’t need a referral from your primary care physician to see a specialist.

Cons:

- PPO insurance can be more expensive than HMO coverage.

- PPOs generally have higher deductibles than HMOs.

- You may have to pay more for services if you see an out-of-network provider.

If you are looking for health insurance, PPO insurance may be a good option for you. It is important to weigh the pros and cons of PPO insurance before making a decision.

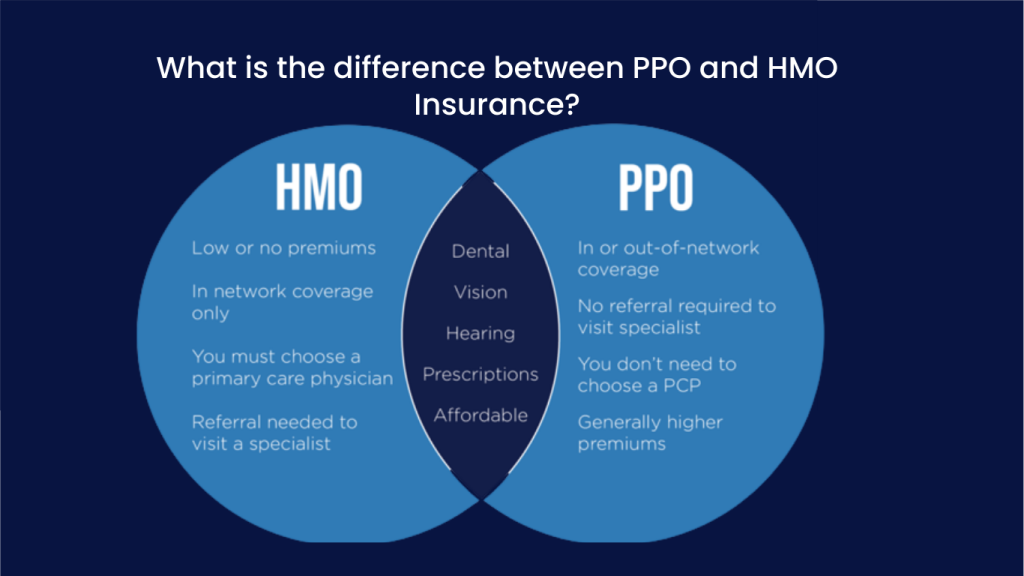

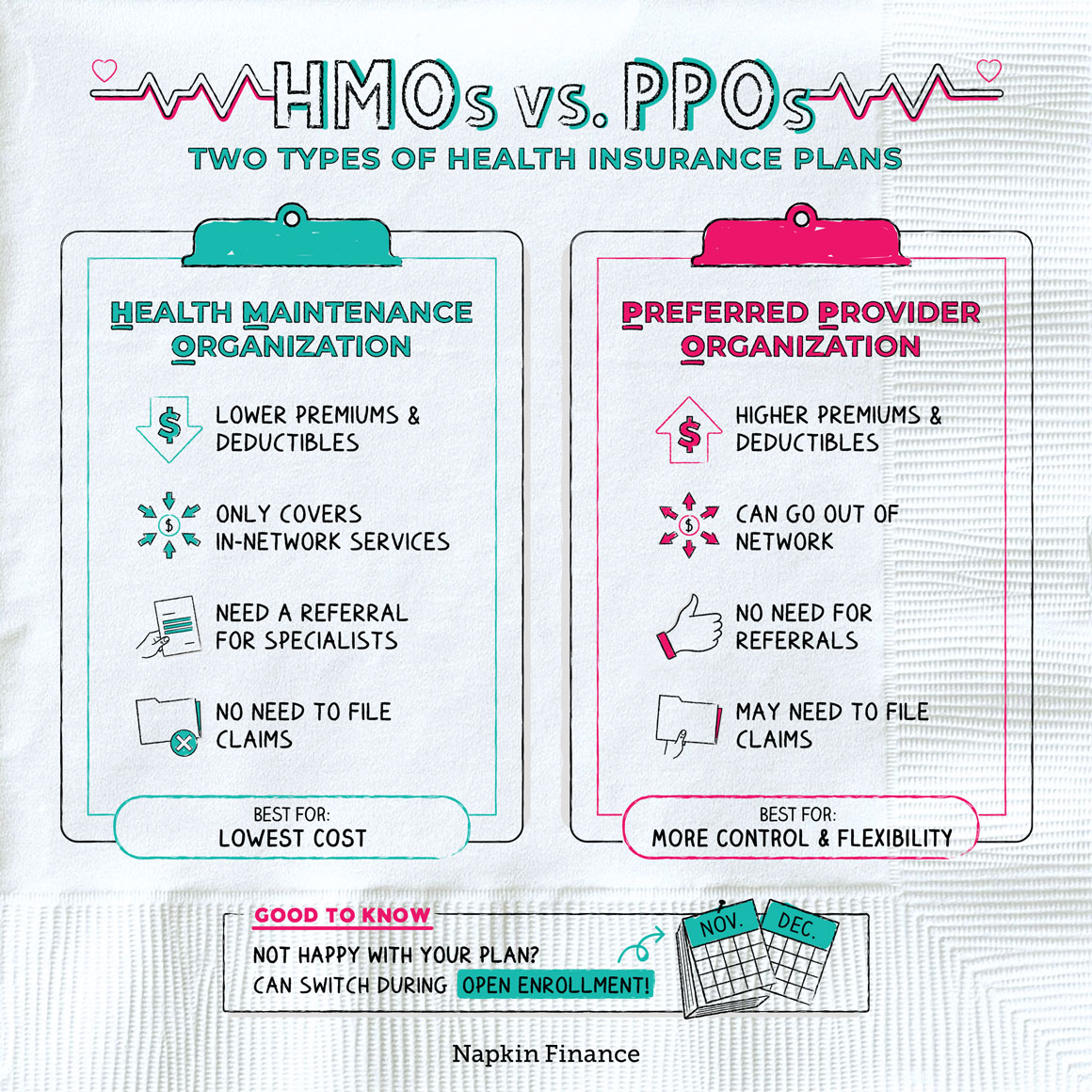

What is the difference between PPO and HMO Insurance?

There are a few key differences between PPO and HMO insurance plans. PPO plans tend to have higher premiums than HMO plans, but they also offer more flexibility in terms of which doctors and hospitals you can use. With an HMO plan, you’ll typically need to choose a primary care physician (PCP) from within the HMO network, and you’ll need to get referrals from your PCP in order to see specialists. PPO plans generally don’t require you to select a PCP or get referrals in order to see specialists.

Another key difference between PPO and HMO insurance plans is that PPO plans offer out-of-network coverage, while HMO plans do not. This means that if you have a PPO plan, you can see doctors and hospitals outside of the PPO network, but you’ll usually have to pay higher out-of-pocket costs. With an HMO plan, you’ll need to stay within the HMO network in order to have your medical expenses covered.

Finally, PPO plans usually have higher deductibles than HMO plans. This means that you’ll have to pay more out of pocket before your PPO plan starts paying for your medical expenses.

If you’re trying to decide between a PPO and an HMO insurance plan, it’s important to consider your needs and budget.

What are the benefits of PPO?

There are many benefits to PPO plans, including the following:

- No referrals are needed to see a specialist.

- Out-of-pocket costs are typically lower than with other types of insurance plans.

- Coverage for preventive care and screenings is typically included.

- PPO plans offer more flexibility than HMOs when it comes to choosing a primary care physician.

- Members can usually see any doctor in the network, without needing a referral.

PPO plans are a great option for those who want more flexibility and lower out-of-pocket costs. If you’re looking for comprehensive coverage, a PPO plan may be the right choice for you. Contact your insurance provider to see if a PPO plan is available to you.

Is a PPO worth it?

The answer to this question depends on a number of factors, including your current health insurance coverage, your health needs, and your budget. If you are currently covered by an HMO or POS plan, you may find that a PPO offers more flexibility in terms of choosing your own doctors and hospitals. Additionally, if you have specific health needs that require a certain type of specialist, a PPO may be a better option as it will likely provide you with more choices in terms of providers. Finally, if you are on a tight budget, an HMO or POS plan may be a better option as they typically have lower premiums than PPO plans.

Ultimately, the best way to determine whether a PPO is worth it for you is to compare your current health insurance coverage with the coverage offered by a PPO plan. Make sure to take into account all of the factors mentioned above, as well as any other factors that are important to you, in order to make the best decision for your individual needs.

Is a $500 deductible Good for health insurance?

When it comes to health insurance, there is no one-size-fits-all answer to the question of whether or not a $500 deductible is good. The amount of your deductible is just one factor to consider when choosing a health insurance plan. Other factors include the monthly premium, out-of-pocket maximum, and coverage for preventive care.

To help you decide if a $500 deductible is right for you, consider your health care needs and budget. If you are generally healthy and don’t anticipate needing many medical services, a high-deductible health plan with a lower monthly premium might be a good option for you. On the other hand, if you have chronic health conditions or anticipate needing frequent medical care, a health plan with a lower deductible and higher monthly premium might be a better choice.

No matter what type of health insurance plan you choose, be sure to shop around and compare plans before enrolling. This will help you find the best possible coverage for your needs and budget.

what is HMO insurance?

An HMO, or Health Maintenance Organization, is a type of health insurance that requires you to use doctors and other healthcare providers who contract with the HMO. You may need to select a primary care physician (PCP) from among the HMO’s network of providers. Your PCP will provide most of your care and refer you to specialists within the HMO network when necessary.

HMOs usually have lower premiums than other types of health insurance, but they also typically have higher deductibles and out-of-pocket costs. HMOs typically cover preventive care, such as annual physicals and vaccines, at no cost to you.

If you’re considering an HMO, it’s important to make sure that the HMO’s network of providers includes doctors and other healthcare providers who can meet your needs. You should also make sure that the HMO covers the services you need. For example, if you have a chronic condition such as diabetes, you’ll want to make sure that the HMO covers the cost of your medication and supplies.

If you’re healthy and don’t have any medical needs, an HMO may be a good option for you. If you have a chronic condition or expect to need a lot of medical care, you may want to consider a different type of health insurance.

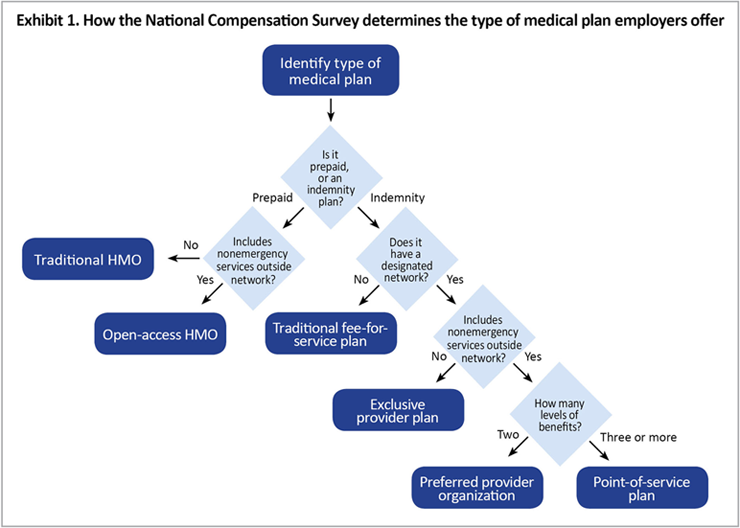

Are EPO and PPO the same?

No, EPO and PPO are not the same. EPO is a type of health insurance that is offered through an employer, while PPO is a type of health insurance that you can purchase on your own. Both types of insurance have their own set of benefits and drawbacks, so it’s important to understand the difference between them before making a decision about which one is right for you. Here’s a quick overview of the key differences between EPO and PPO health insurance plans:

- With an EPO plan, you can only receive care from providers who are in your network. This means that you may have to pay more out-of-pocket costs if you see a provider who is out-of-network.

- PPO plans, on the other hand, allow you to receive care from any provider, but you’ll pay more for services if you see an out-of-network provider.

- EPO plans typically have lower premiums than PPO plans. However, this may be offset by the higher out-of-pocket costs associated with EPO plans.

- PPO plans typically have higher deductibles than EPO plans. This means that you’ll have to pay more out of pocket before your insurance plan starts paying for covered services.

So, which type of plan is right for you? That depends on a number of factors, including your budget and your healthcare needs. If you’re healthy and don’t mind paying a little bit more out-of-pocket for services, an EPO plan may be a good option. However, if you have a chronic condition or expect to need a lot of medical care, a PPO plan may be a better choice.

If you’re still not sure which type of plan is right for you, talk to your doctor or a licensed insurance agent. They can help you compare plans and find the one that best meets your needs.

- With an EPO plan, you can only receive care from providers who are in your network.

Conclusion:

In conclusion, PPO insurance is a type of health insurance that allows you to see any doctor that accepts your insurance. There is no need to get a referral from a primary care physician. You will also have lower out-of-pocket costs with this type of insurance. PPOs typically have higher monthly premiums than HMOs, but they offer more flexibility and freedom when it comes to choosing your doctor.

If you are looking for health insurance that offers more freedom and flexibility, then a PPO plan may be right for you. Be sure to compare different plans and rates before enrolling in order to find the best coverage for your needs.

You can read more for further information:

How Much Does Invisalign Cost Without Insurance For 5 Prime Locations?

3 Comments